Growing Focus on Energy Efficiency

The growing focus on energy efficiency in the automotive sector is a significant driver for the Automotive Battery Management System Industry. As fuel prices rise and environmental concerns mount, automakers are increasingly prioritizing energy-efficient technologies. Battery management systems play a crucial role in optimizing energy usage, extending battery life, and enhancing vehicle performance. In 2025, the market for energy-efficient automotive technologies is expected to reach 50 billion dollars, underscoring the importance of effective battery management solutions. This trend suggests that the Vehicle Battery Management System Market will experience heightened demand as manufacturers seek to improve energy efficiency in their vehicles.

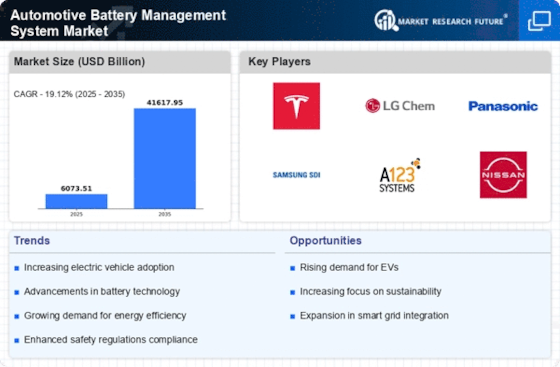

Rising Demand for Electric Vehicles

The increasing demand for electric vehicles (EVs) is a primary driver for the Automotive Battery Management System Sector. As consumers become more environmentally conscious, the shift towards EVs accelerates. In 2025, it is estimated that the sales of electric vehicles will surpass 10 million units, necessitating advanced battery management systems to optimize performance and longevity. These systems are crucial for monitoring battery health, ensuring safety, and enhancing the overall efficiency of EVs. Consequently, the EV Battery Management System Market is poised for substantial growth as manufacturers seek to integrate sophisticated battery management solutions into their electric vehicle offerings.

Government Regulations and Incentives

Government regulations and incentives aimed at promoting electric vehicles and sustainable practices are pivotal in shaping the Automotive Battery Management System Industry. Many countries have implemented stringent emissions regulations, pushing automakers to adopt cleaner technologies. Additionally, various incentives, such as tax breaks and subsidies for EV purchases, further stimulate market growth. In 2025, it is anticipated that regulatory frameworks will become even more stringent, compelling manufacturers to invest in advanced battery management systems to comply with these regulations. This regulatory environment is likely to bolster the Automotive BMS Market as companies strive to meet compliance and capitalize on incentives.

Increased Investment in Research and Development

Increased investment in research and development (R&D) within the automotive sector is a key driver for the Automotive Battery Management System Sector. As competition intensifies, manufacturers are allocating more resources to innovate and enhance battery technologies and management systems. This focus on R&D is expected to yield breakthroughs that improve battery performance, safety, and longevity. In 2025, R&D spending in the automotive industry is projected to exceed 100 billion dollars, indicating a strong commitment to advancing battery management solutions. This investment trend is likely to propel the Vehicle Battery Management System Industry forward, fostering innovation and technological advancements.

Technological Advancements in Battery Technology

Technological advancements in battery technology significantly influence the Automotive Battery Management System Industry. Innovations such as solid-state batteries and lithium-sulfur batteries promise higher energy densities and improved safety profiles. As these technologies mature, the need for advanced battery management systems becomes more pronounced to manage the complexities associated with new battery chemistries. In 2025, the market for advanced battery technologies is projected to reach approximately 30 billion dollars, driving demand for sophisticated management systems that can handle the intricacies of next-generation batteries. This trend indicates a robust growth trajectory for the EV Battery Management System Industry.