Consumer Preference for Smart Vehicle Features

The automotive intelligence-battery-sensor market is significantly influenced by changing consumer preferences towards smart vehicle features. As consumers increasingly seek connectivity and automation in their vehicles, manufacturers are compelled to integrate advanced sensors and battery technologies. This shift is evident in the rising popularity of features such as infotainment systems, autonomous driving capabilities, and real-time vehicle diagnostics. Market Research Future indicates that nearly 60% of consumers prioritize smart features when purchasing a vehicle. Consequently, the automotive intelligence-battery-sensor market is poised for growth, as manufacturers invest in developing innovative solutions that cater to these evolving consumer demands. This trend not only enhances the driving experience but also positions the market for sustained expansion.

Government Initiatives Supporting Electric Mobility

Government initiatives aimed at promoting electric mobility play a pivotal role in shaping the automotive intelligence-battery-sensor market. In the US, various federal and state programs provide incentives for electric vehicle adoption, including tax credits and rebates. These initiatives are designed to reduce greenhouse gas emissions and promote sustainable transportation. As a result, the demand for advanced battery technologies and sensors is expected to rise. The automotive intelligence-battery-sensor market is likely to see increased investments, with projections indicating a market size of over $10 billion by 2025. This supportive regulatory environment fosters innovation and encourages manufacturers to develop cutting-edge technologies that align with government objectives, thereby driving growth in the automotive intelligence-battery-sensor market.

Rising Demand for Advanced Driver Assistance Systems

The automotive intelligence-battery-sensor market experienced a notable surge in demand for advanced driver assistance systems (ADAS). As safety regulations tighten, manufacturers are compelled to integrate sophisticated sensor technologies into vehicles. This trend is reflected in the increasing investment in ADAS, which is projected to reach approximately $30 billion by 2026 in the US. The integration of sensors enhances vehicle safety, reduces accidents, and improves overall driving experience. Consequently, the automotive intelligence-battery-sensor market benefits from this heightened focus on safety, as sensors play a crucial role in enabling features such as lane-keeping assistance and adaptive cruise control. The growing consumer awareness regarding vehicle safety further propels this demand, indicating a robust growth trajectory for the automotive intelligence-battery-sensor market.

Technological Innovations in Battery Management Systems

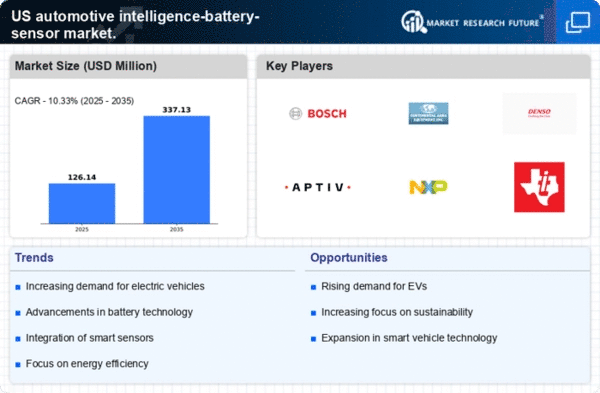

Technological advancements in battery management systems (BMS) significantly influence the automotive intelligence-battery-sensor market. As electric vehicles (EVs) gain traction, the need for efficient battery management becomes paramount. Innovations in BMS enhance battery performance, longevity, and safety, which are critical for EV adoption. The US market anticipates a compound annual growth rate (CAGR) of around 20% for BMS technologies by 2027. These systems utilize advanced sensors to monitor battery health, temperature, and charge levels, ensuring optimal performance. The automotive intelligence-battery-sensor market stands to benefit from these innovations, as they not only improve the efficiency of electric vehicles but also contribute to the overall sustainability goals of the automotive industry.

Integration of Artificial Intelligence in Automotive Systems

The integration of artificial intelligence (AI) into automotive systems is emerging as a transformative driver for the automotive intelligence-battery-sensor market. AI technologies enhance the functionality of sensors and battery management systems, enabling predictive maintenance and real-time data analysis. This integration allows for improved vehicle performance and efficiency, which is increasingly sought after by consumers. The US automotive sector is projected to invest over $10 billion in AI technologies by 2025, indicating a strong commitment to innovation. As AI continues to evolve, its application in the automotive intelligence-battery-sensor market is likely to expand, fostering advancements in autonomous driving and smart vehicle technologies. This trend suggests a promising future for the market, as AI-driven solutions become integral to modern automotive design.