Artisanal Ice Cream Market Summary

As per Market Research Future analysis, the Artisanal Ice Cream Market Size was estimated at 63.6 USD Billion in 2024. The Artisanal Ice Cream industry is projected to grow from 66.27 USD Billion in 2025 to 100.0 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.2% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Artisanal Ice Cream Market is experiencing dynamic growth driven by innovative flavors and a focus on sustainability.

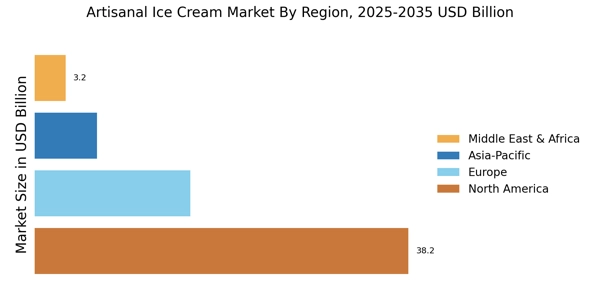

- North America remains the largest market for artisanal ice cream, characterized by a diverse range of flavors and premium offerings.

- The Asia-Pacific region is emerging as the fastest-growing market, with increasing consumer interest in unique and exotic flavors.

- Conventional ice cream continues to dominate the market, while lactose-free options are rapidly gaining traction among health-conscious consumers.

- Key market drivers include a strong emphasis on sustainability and local sourcing, which resonate with today's environmentally aware consumers.

Market Size & Forecast

| 2024 Market Size | 63.6 (USD Billion) |

| 2035 Market Size | 100.0 (USD Billion) |

| CAGR (2025 - 2035) | 4.2% |

Major Players

Jeni's Splendid Ice Creams (US), Salt & Straw (US), Ample Hills Creamery (US), Gelato Fiasco (US), Van Leeuwen Ice Cream (US), Little G Ice Cream (US), Ciao Bella Gelato (US), Häagen-Dazs (US)