Functional Ice Cream Market Summary

As per Market Research Future analysis, the Functional Ice Cream Market Size was estimated at 0.24 USD Billion in 2024. The Functional Ice Cream industry is projected to grow from USD 0.2576 Billion in 2025 to USD 0.5232 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.34% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Functional Ice Cream Market is experiencing a dynamic shift towards health-oriented products and innovative offerings.

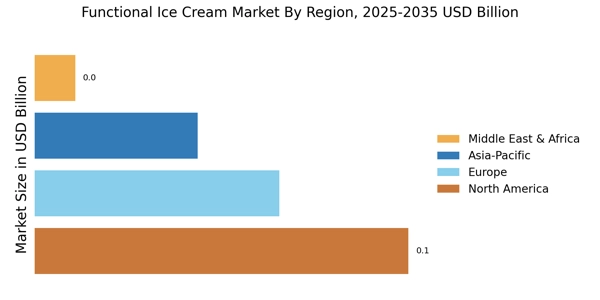

- The market is increasingly driven by a health and wellness focus, particularly in North America, the largest market.

- Innovative flavors and unique ingredients are gaining traction, with chocolate remaining the largest segment and vanilla emerging as the fastest-growing.

- Sustainability and ethical sourcing practices are becoming essential, especially in the rapidly expanding Asia-Pacific region.

- Health-conscious consumer trends and the rise of plant-based alternatives are key drivers propelling the growth of lactose-free and vegan segments.

Market Size & Forecast

| 2024 Market Size | 0.24 (USD Billion) |

| 2035 Market Size | 0.5232 (USD Billion) |

| CAGR (2025 - 2035) | 7.34% |

Major Players

Unilever (GB), Nestle (CH), General Mills (US), Häagen-Dazs (US), Breyers (US), Edy's (US), So Delicious Dairy Free (US), Yasso (US), Halo Top (US)