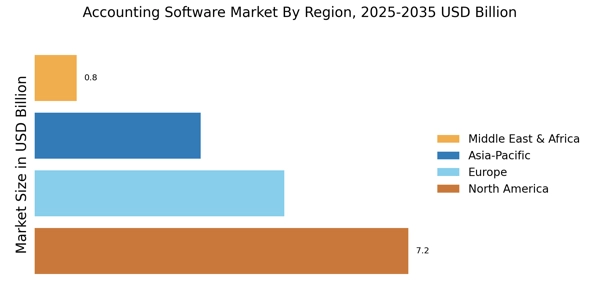

By Region, the study segments the market into North America, Europe, Asia-Pacific, Middle East & Africa, and South America. Currently, Accounting Software Market solutions are being extensively used in North America. There are a greater number of industrial sectors, educational institutions, and business segments in the region that require proper accounting management. North American end-user applications have invested in Accounting Software Market solutions due to developed infrastructure and time constraints. Accounting Software Market solutions are being used by an increasing number of healthcare, information technology, manufacturing, E-Commerce, and retail businesses to increase revenue.

In North America, the economic climate provides additional support for investing in the costs associated with installation, maintenance, and other related fees. The North American market benefits from strong adoption of American accounting software, supported by advanced IT infrastructure and regulatory standards.

It is expected that the Asia Pacific region will exhibit the fastest CAGR during the forecast period. One of the major drivers for the growth of the accounting software market in the Asia-Pacific region is the increasing adoption of digital technologies by small and medium-sized enterprises (SMEs). The increasing awareness of the benefits of automation and the need to comply with various financial regulations are driving the adoption of accounting software in this region. Demand for Asia accounting software is rising due to SME digitization and regulatory modernization across emerging economies.

Further, the countries considered in the scope of the accounting software market are the US, Canada, Mexico, UK, Germany, France, Italy, Spain, Switzerland, Austria, Belgium, Denmark, Finland, Greece, Hungary, Italy, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovakia, Sweden, Romania, Ireland, China, Japan, Singapore, Malaysia, Indonesia, Philippines, South Korea, Hong Kong, Macau, Singapore, Brunei, India, Australia & New Zealand, South Africa, Egypt, Nigeria, Saudi Arabia, Qatar, United Arab Emirates, Bahrain, Kuwait, and Oman, Brazil, Argentina, Chile, and others. Adoption of international accounting software is increasing as multinational enterprises seek standardized global financial reporting.