Focus on Data Security and Privacy

In an era where data breaches and cyber threats are prevalent, the accounting software market is witnessing a heightened focus on data security and privacy. Businesses are increasingly aware of the importance of safeguarding sensitive financial information, leading to a demand for software solutions that offer robust security features. Compliance with regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) is becoming essential for software providers. This emphasis on security is likely to drive innovation within the accounting software market, as companies seek to enhance their offerings to meet the evolving needs of clients concerned about data protection.

Integration with Other Business Systems

The integration of accounting software with other business systems is emerging as a critical driver in the accounting software market. Organizations are seeking solutions that seamlessly connect with customer relationship management (CRM), enterprise resource planning (ERP), and other operational tools. This integration facilitates a holistic view of business performance and enhances operational efficiency. As businesses increasingly recognize the value of interconnected systems, the demand for accounting software that offers easy integration capabilities is likely to rise. This trend may contribute to a more streamlined financial management process, ultimately benefiting the overall performance of organizations.

Increased Demand for Remote Work Solutions

The shift towards remote work has significantly impacted the accounting software market. As businesses adapt to flexible work environments, there is a growing need for cloud-based accounting solutions that facilitate collaboration and accessibility. This trend is particularly pronounced among small to medium-sized enterprises (SMEs), which are increasingly adopting accounting software that allows for real-time data access and remote collaboration. The demand for such solutions is expected to drive market growth, with estimates suggesting that the accounting software market could expand by over 10% annually as organizations prioritize tools that support remote work capabilities.

Technological Advancements in Accounting Software

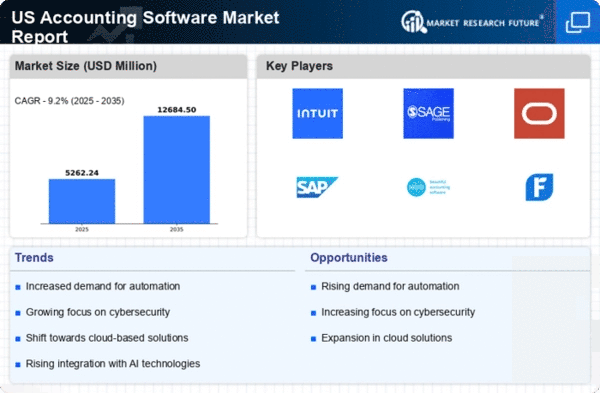

The accounting software market is experiencing a surge in technological advancements, which is driving its growth. Innovations such as automation, machine learning, and advanced analytics are enhancing the functionality of accounting software. These technologies enable businesses to streamline their financial processes, reduce errors, and improve decision-making. According to recent data, the market for accounting software is projected to reach approximately $11 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 8%. This growth is indicative of the increasing reliance on sophisticated software solutions in the accounting sector, as organizations seek to optimize their financial operations and maintain competitiveness in a rapidly evolving landscape.

Growing Importance of Real-Time Financial Reporting

The need for real-time financial reporting is becoming increasingly vital in the accounting software market. Businesses are recognizing the advantages of having immediate access to financial data, which allows for timely decision-making and strategic planning. This trend is particularly relevant in fast-paced industries where agility is crucial. As a result, accounting software that provides real-time insights and analytics is gaining traction among organizations. The market is expected to see a shift towards solutions that prioritize real-time reporting capabilities, reflecting the growing demand for transparency and responsiveness in financial management.