Market Analysis

In-depth Analysis of Accounting Software Market Industry Landscape

Accounting software stands as a catalyst for enhancing the efficiency of financial operations, seamlessly managing, tracking, and recording financial transactions. The utilization of such software empowers companies to effectively oversee and maintain their accounts receivables, payables, general ledger, business payroll, and other integral business modules. These software solutions encompass a spectrum of features, including expense management and financial forecasting, offering a cost-effective and time-saving mechanism that significantly bolsters a company's productivity. The modern iterations of accounting software introduce automation through pre-defined task management, thereby conserving valuable time. For instance, critical vendor information can be inputted into the system, enabling automatic payments to be scheduled for each vendor on their respective due dates every month. Additionally, once customer information is integrated into the system, the software can automatically dispatch recurring invoices to these customers. Such automated features are particularly indispensable for financial institutions tasked with managing a myriad of accounts for numerous customers.

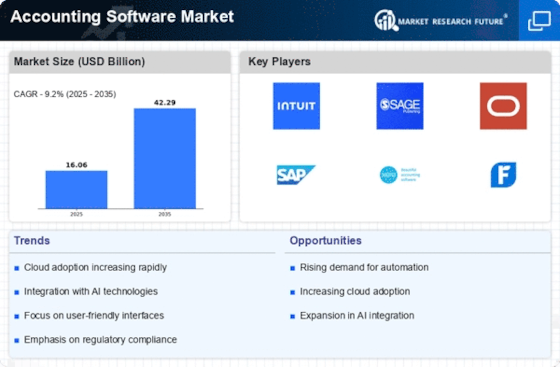

The market hosts an array of accounting software solutions preferred across diverse industries, including names like FreshBooks, QuickBooks, Xero, SAP S/4HANA, and Sage Business Cloud Accounting.

Furthermore, the realm of automated solutions extends its reach to fraud detection, with providers like Plaid spearheading advancements in this domain. Collaborating with financial institutions such as Goldman Sachs, Citigroup, and American Express, Plaid operates by analyzing interactions across varying conditions and variables, crafting multiple unique patterns that are constantly updated in real time. Functioning as a widget, Plaid serves as a secure link between a bank and the client's application, ensuring the integrity of financial transactions.

The utilization of accounting software serves as a catalyst, streamlining financial operations and providing a comprehensive solution for managing and recording financial transactions. These software solutions streamline tasks such as managing accounts receivables, payables, payroll, and more, boosting efficiency and productivity. Moreover, accounting software encompasses additional features like expense management and financial forecasting, which not only save time but also contribute to cost-effectiveness.

Modern accounting software thrives on automation, simplifying tasks through predefined workflows. For instance, vendors' details can be seamlessly integrated into the system, facilitating automated payments on scheduled due dates. Similarly, customer information inputted into the system can trigger the automated dispatch of recurring invoices. Such automation proves invaluable, especially for financial institutions handling multiple accounts for numerous clients.

The market showcases a diverse range of accounting software solutions catering to various industries. Names like FreshBooks, QuickBooks, Xero, SAP S/4HANA, and Sage Business Cloud Accounting hold prominence across industries, offering comprehensive financial management tools.

Additionally, the ambit of automated solutions extends to fraud detection, spearheaded by innovators like Plaid. Partnering with major financial institutions, Plaid employs advanced analysis of diverse interactions, creating and constantly updating multiple unique patterns in real time. As a secure widget bridging banks and client applications, Plaid ensures the security and integrity of financial transactions.

Leave a Comment