Market Analysis

In-depth Analysis of Phosphoric Acid Market Industry Landscape

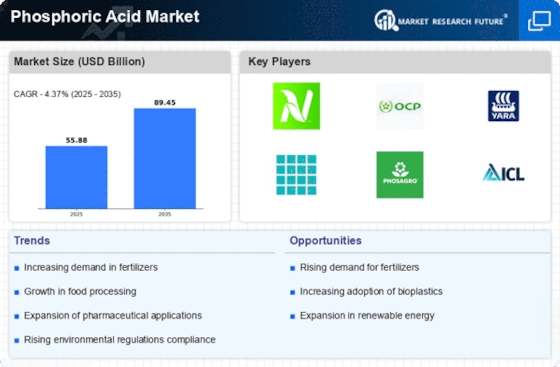

The phosphoric acid market is currently witnessing significant transformations in its dynamics due to several factors affecting both supply and demand within the chemistry and agriculture sectors. A major consumer of this vital chemical compound, which is widely used in various applications, is the agricultural sector. One of the major drivers of market dynamics is the increasing demand for fertilizers, and phosphoric acid is a critical component used in its production. The agricultural sector heavily influences the market dynamics of the phosphoric acid industry. Phosphoric acid is an essential ingredient in manufacturing phosphate fertilizers, which help promote plant growth by making crops more productive. That is why it has been suggested that phosphoric acid can serve as a solution to nutrient deficiencies within soils, which is witnessed within this particular industry. Additionally, the market dynamics are influenced by the industrial sector and its varied applications. Detergent production, water treatment chemicals, and food & beverages all require phosphoric acid. The versatility of phosphoric acid in addressing the diverse needs of numerous manufacturing and processing industries has effects on market dynamics. Technological advancements in phosphoric acid production have led to changes in market dynamics. Through these processes, continuous innovation, such as those involving improved extraction methods or environmentally friendly ways of producing it, can be applied to ensure that less land boundary modification occurs from farming practices geared towards enhancing phosphatic rock processing efficiency. Environmental concerns and sustainable practices are important drivers of market dynamics. The chemical industry is increasingly feeling the weight of more sustainable practices, and those phosphoric acid producers who embrace environmentally responsible sourcing, production processes, and waste disposal play a role in market dynamics by following the broader trend of sustainable chemical solutions. Global economic conditions and agricultural trends influence market dynamics in the Phosphoric Acid sector. Manufacturing capabilities, quality assurance, supply stability, and retention contribute greatly to market dynamics on the supply side. Regulatory standards and compliance feature significantly in the phosphoric acid industry as they affect its market dynamics. Governments and regulatory bodies establish guidelines for the use and production of chemicals to ensure safety, environmental protection, and conformity to quality standards.

Leave a Comment