Top Industry Leaders in the Phosphoric Acid Market

Phosphoric acid, a seemingly innocuous chemical compound, plays a critical role in our world. From fertilizers to food additives and even electronics, its applications are diverse and its market is substantial. But beneath this seemingly static surface lies a dynamic and competitive landscape, shaped by evolving regulations, resource constraints, and the ever-changing demands of global agriculture. Let's delve into the intricacies of this market, exploring its key players, their strategies, and the factors shaping their success.

Phosphoric acid, a seemingly innocuous chemical compound, plays a critical role in our world. From fertilizers to food additives and even electronics, its applications are diverse and its market is substantial. But beneath this seemingly static surface lies a dynamic and competitive landscape, shaped by evolving regulations, resource constraints, and the ever-changing demands of global agriculture. Let's delve into the intricacies of this market, exploring its key players, their strategies, and the factors shaping their success.

A Diverse Blend of Players:

-

Global Giants: Leading the pack are established players like OCP Group (Morocco), Mosaic (US), Eurochem (Switzerland), and China National Bluestar (China) with vast production capacities, geographically diverse operations, and strong financial backing. -

Regional Powerhouses: Companies like Indian Farmers Fertiliser Cooperative Limited (India), PhosAgro (Russia), and Yara International (Norway) cater to specific regional needs, offering cost-competitive solutions and leveraging their local expertise. -

Niche Specialists: Smaller players like Prayon (Belgium) and Innophos Holdings (US) focus on specialty phosphoric acid grades for food, pharmaceuticals, and other high-value applications.

Strategies for a Thriving Formula:

-

Resource Efficiency: Optimizing mining and processing methods to minimize waste and maximize resource extraction is crucial in a market facing potential supply constraints. -

Technological Innovation: Developing new extraction and purification technologies, like cleaner production methods and closed-loop systems, is key for sustainability and cost reduction. -

Product Diversification: Offering a diverse range of phosphoric acid grades tailored to specific applications attracts a wider customer base and mitigates market fluctuations. -

Geographical Expansion: Establishing production facilities in regions with growing agricultural demand presents significant growth opportunities. -

Strategic Partnerships: Collaborations with fertilizer companies, research institutions, and logistics providers drive market access, innovation, and efficiency.

Factors Shaping Market Share:

-

Production Capacity and Efficiency: Having efficient and large-scale production facilities with low operating costs is crucial for competitiveness. -

Resource Availability and Costs: Access to phosphate rock reserves and fluctuations in their prices significantly impact production costs and profitability. -

Fertilizer Demand and Prices: The health of the global fertilizer market directly impacts phosphoric acid demand and prices, making market analysis and forecasting critical. -

Environmental Regulations: Stringent regulations on mining practices, waste disposal, and air emissions require continuous adaptation and investment in sustainable technologies. -

Logistics and Distribution Network: Efficient transportation and storage infrastructure are essential for timely delivery and cost-effective distribution.

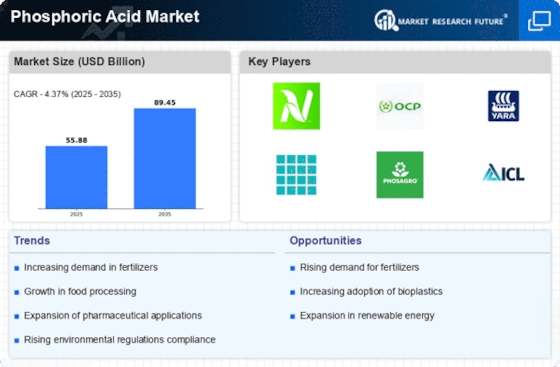

Key Companies in the Phosphoric Acid Market include

ICL Group Ltd. (Israel)

OCP Group S.A. (Morocco)

The Mosaic Company (US)

Nutrien Ltd. (Netherlands)

Eurochem Group (Switzerland)

IFFCO (India)

Arkema (France)

Solvay (Belgium)

Ma’aden (Saudi Arabia)

Phosagro Group of Companies (Russia)

Recent Developments:

-

August 2023: OCP Group announces a new partnership with a technology company to develop a digital platform for optimizing phosphate rock extraction. -

September 2023: OCI N.V. unveils a new production line for high-purity phosphoric acid for the food and beverage industry, targeting specialized applications. -

November 2023: China National Bluestar collaborates with a research institute to develop a new, more efficient method for extracting phosphoric acid from low-grade ores. -

December 2023: A startup develops a novel bio-based phosphoric acid production process, offering a potential alternative to traditional methods.