Phosphoric Acid Size

Phosphoric Acid Market Growth Projections and Opportunities

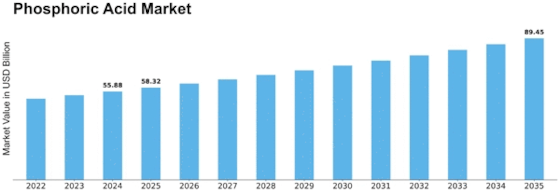

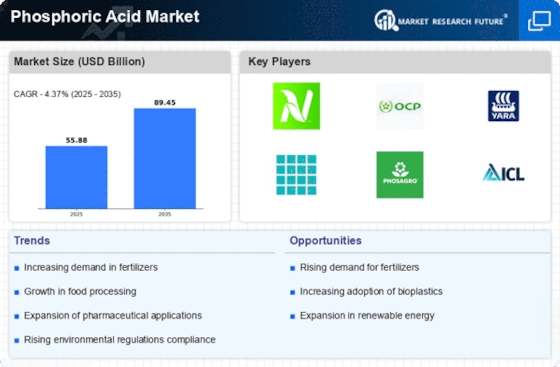

The market size of the phosphoric acid reached USD 52,317.08 million in 2022. The industry is projected to grow from USD 54,420.23 million in 2023 to USD 72,722.13 million by 2030 at a CAGR of 4.20%. The phosphoric Acid market is shaped by a combination of factors that collectively influence its dynamics. Phosphoric acid is an important industrial chemical that has found wide applications in agriculture, food and beverages, detergent production, and fertilizer manufacturing, among other sectors. One of the main drivers for this market is the importance of phosphoric acid as a critical component of agricultural practices for phosphate fertilizers. The global demand for food production and the need to enhance crop yields contribute significantly to the growing market for phosphoric acid. Technological advancements have played a significant role in phosphoric acid market dynamics, hence increasing market share. Ongoing research focuses on improving manufacturing process efficiency and sustainability, exploring innovative extraction methods, and optimizing the use of raw materials. Phosphoric Acid Market is affected by global agricultural practices and food demand. As the human population continues to grow, there will be a higher demand for phosphoric acid because it's used in the production of phosphate-based fertilizers that are aimed at supporting sustainable agriculture while guaranteeing food security. Governmental regulations and environmental considerations play an important role in shaping Phosphoric Acid market space. In order to produce phosphorus acids, manufacturers must pay attention to compliance with environmentally approved standards and health safety legislations, including restrictions on agro-phosphorous runoffs. Changes brought by the legislation include encouraging sustainable practices or reducing adverse impacts caused by chemicals, thereby affecting this industry through leading innovations and determining how things are done. Phosphoric Acid Market relies on different economic factors like industrial demand along with agricultural spending./The Phosphoric Acid Market depends on developments within the chemical industry. Production efficiency is enhanced through research and development, exploring new areas where phosphoric acid can be applied, and meeting the changing requirements of the industry. The phosphoric Acid Market is influenced by global trade dynamics as well as supply chain perspectives./Consumer awareness and education about sustainable agriculture and the role of phosphoric acid contribute to market growth. As farmers, agricultural professionals, and industries become more informed about how phosphoric acid can promote healthier crops with more available nutrients, there will be a rise in demand for this material. There are, however, important initiatives that need to be taken, such as educational programs aimed at encouraging sustainability in farming and communication efforts towards building acceptance, plus confidence in using this chemical within agriculture.

Leave a Comment