Market Trends

Key Emerging Trends in the Phosphoric Acid Market

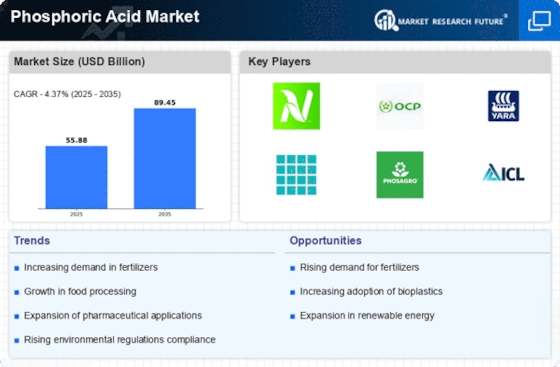

The current Phosphoric Acid market reflects various trends driven by its multiple applications across different industries, including agriculture, food & beverage, and chemicals, among others. It has been observed that Phosphoric Acid is an important chemical compound that has attracted significant demand, hence changing the market dynamics accordingly. For instance, phosphoric acid is increasingly used as a fertilizer within this segment. Additionally, the food-grade phosphoric acid market is expanding rapidly. As such, the latter has been found to be applicable in numerous foods and beverages, where it acts as an acidic agent or an acidity regulator, resulting in their distinct tart taste characteristics. Hence, increased consumption of soft drinks like carbonated beverages coupled with processed foods such as convenience products contributes to demands for this product on a global scale within the food sector. This shows how consumer preferences vary over time while phosphoric acid remains key to meeting dynamic demands for diverse appealing foods and drinks. Furthermore, there has been remarkable growth in the industrial-grade phosphoric acid market recently, too. In terms of making detergents or treating metals or water, this product plays a vital role in several industrial processes worldwide today due to its multiple uses mentioned above. Thus, the increasing industrial applications of phosphoric acid are in line with global manufacturing activities that have expanded significantly, as well as wider industrialization. Besides, the electronic-grade phosphoric acid industry is expected to witness robust growth. High-purity phosphoric acid is used to produce electronic components. It is also utilized as a cleaning agent in semiconductor manufacturing processes due to the development of electronics and semiconductor industries. Therefore, technological changes in this field and the demand for accuracy in the production of electronic devices necessitate the use of this substance. Government food safety regulations and various standards on environmental concerns and industrial chemical use are seen to be driving trends in phosphoric acid markets. Regulatory authorities worldwide have introduced standards aimed at ensuring that phosphoric acid can be used safely within their jurisdictions. However, there are challenges, including environmental concerns, competition from alternative sources of phosphorus, and volatility in the prices of raw materials. Phosphorus runoffs into the water coming from agricultural activities associated with the use of fertilizers made up of phosphoric acid have raised questions about the quality of water as well as sustainability issues, among others. These challenges require continuous research so as to develop sustainable environmental practices for managing phosphorous.

Leave a Comment