Market Share

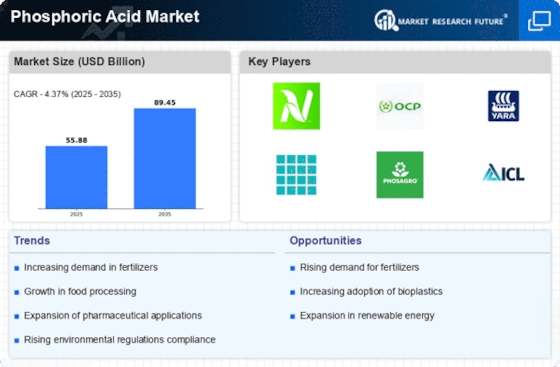

Phosphoric Acid Market Share Analysis

In order to stand out in the highly competitive Phosphoric Acid Market, companies utilize various strategies. One of these strategies involves applying continuous innovation to improve phosphoric acid production processes and their applications so as to gain more market share. R&D investments help companies improve the quality, purity, and efficiency of their products, like phosphoric acid used for fertilizers, different food & beverages, and industrial processes, among others. Price differentiation determines the positioning of an organization or product within a specific sector./Some companies adopt a cost leadership approach, thereby selling their phosphorous acids at reduced prices, which is mostly preferred by cost-conscious firms operating within sectors such as agriculture. In contrast, others adopt premium pricing strategies focusing on improved purity standards along with quality controls or specialized formulations. Developing an efficient and expansive distribution network is key to market share positioning. Firms team up with distributors, agribusiness dealers, and chemical companies to ensure nationwide availability of their phosphoric acid. In addition, forming strategic alliances and partnerships with leading participants in the food & beverage, agriculture as well as chemical sectors is vital when it comes to establishing market share in the Phosphoric Acid Market. These could take the form of associations with agricultural cooperatives, food processors, or large-scale manufacturers through which firms can capitalize on synergies, venture into new markets, and meet phosphoric acid specifications, regulatory demands, as well as changes in industry standards together. As a result of this approach, joint ventures involving cooperative agreements among various businesses or even mergers and acquisitions have a significant contribution to be made toward companies' respective shares of the overall Phosphoric Acid Market. Marketing efficiency plus branding efforts that are superbly executed serve as crucial determinants for success in gaining market share. This includes creating a strong brand identity while promoting the company's phosphoric acid across different platforms, such as social media marketing and taking part in conferences related to their industry. Innovation, therefore, leads where successful market share positioning in the Phosphoric Acid Market is concerned. Companies spend resources on research and development so that they can introduce newer formulations of phosphoric acid that comply with changing environmental standards, compatibility targets, and emerging technologies. A customer focus also plays a big role in determining market share. By serving farmers, food processors, or industrial producers' specific requirements regarding phosphoric acid products, they offer tailor-made goods.

Leave a Comment