Rise in Smart Building Initiatives

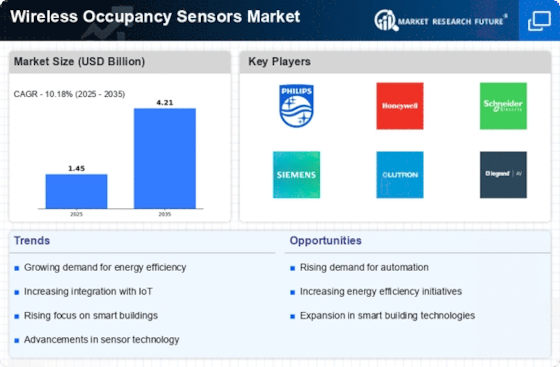

The Wireless Occupancy Sensors Market is significantly influenced by the rise in smart building initiatives. As urbanization accelerates, the construction of smart buildings equipped with advanced technologies is becoming increasingly prevalent. These buildings leverage wireless occupancy sensors to optimize space utilization and enhance occupant comfort. The integration of these sensors with building management systems allows for real-time data collection and analysis, facilitating informed decision-making. Market data suggests that the smart building sector is projected to grow at a compound annual growth rate of over 10% in the coming years. This growth trajectory indicates a robust demand for wireless occupancy sensors, as they play a crucial role in the functionality and efficiency of smart buildings.

Growing Demand for Energy Efficiency

The Wireless Occupancy Sensors Market is experiencing a notable surge in demand for energy-efficient solutions. As organizations increasingly prioritize sustainability, the adoption of wireless occupancy sensors has become a strategic approach to reduce energy consumption. These sensors enable automatic lighting and HVAC control based on occupancy, leading to significant energy savings. According to recent estimates, buildings equipped with occupancy sensors can achieve energy savings of up to 30%. This trend is further fueled by regulatory frameworks promoting energy efficiency, compelling businesses to invest in technologies that align with these mandates. Consequently, the Wireless Occupancy Sensors Market is poised for substantial growth as more entities recognize the financial and environmental benefits of integrating these systems into their operations.

Increased Awareness of Workplace Safety

The Wireless Occupancy Sensors Market is also benefiting from heightened awareness regarding workplace safety. Organizations are increasingly recognizing the importance of creating safe environments for employees, which includes effective monitoring of occupancy levels. Wireless occupancy sensors contribute to this objective by ensuring that spaces are adequately lit and ventilated based on actual occupancy. This not only enhances safety but also improves overall employee productivity. Furthermore, the implementation of these sensors can assist in compliance with safety regulations, thereby reducing liability risks for businesses. As a result, the demand for wireless occupancy sensors is expected to rise as companies prioritize safety and well-being in their operational strategies.

Government Incentives for Smart Technologies

The Wireless Occupancy Sensors Market is positively impacted by government incentives aimed at promoting smart technologies. Various governments are implementing policies and financial incentives to encourage the adoption of energy-efficient solutions, including wireless occupancy sensors. These initiatives often include tax credits, rebates, and grants for businesses that invest in smart technologies. Such support not only reduces the financial burden on organizations but also accelerates the transition towards more sustainable practices. As a result, the Wireless Occupancy Sensors Market is likely to experience increased growth, as more companies take advantage of these incentives to enhance their operational efficiency and reduce their environmental footprint.

Technological Innovations in Sensor Technology

The Wireless Occupancy Sensors Market is witnessing rapid technological innovations that enhance the functionality and appeal of occupancy sensors. Advances in sensor technology, such as improved motion detection capabilities and integration with Internet of Things (IoT) platforms, are driving market growth. These innovations enable more accurate occupancy detection and facilitate seamless communication between devices. Market analysts indicate that the adoption of IoT-enabled occupancy sensors is likely to increase, as they offer enhanced data analytics and remote monitoring capabilities. This trend suggests a promising future for the Wireless Occupancy Sensors Market, as businesses seek to leverage cutting-edge technology to optimize their operations and improve energy management.