Emergence of 5G Technology

The Wireless IoT Sensors Market is poised for growth due to the emergence of 5G technology, which promises to revolutionize connectivity for IoT devices. The deployment of 5G networks is expected to enhance the performance of wireless sensors by providing faster data transmission and lower latency. This technological advancement is likely to facilitate the deployment of more sophisticated IoT applications across various sectors, including transportation, healthcare, and smart homes. The 5G market is projected to reach 700 billion dollars by 2025, creating a conducive environment for the proliferation of wireless IoT sensors. As industries leverage the capabilities of 5G, the demand for advanced wireless sensors is expected to escalate, indicating a significant shift in the IoT landscape.

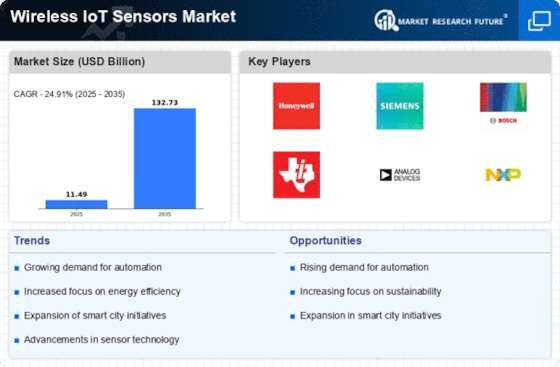

Rise in Industrial Automation

The Wireless IoT Sensors Market is significantly influenced by the rise in industrial automation across various sectors. Industries are increasingly adopting IoT solutions to enhance operational efficiency and reduce costs. The market for industrial IoT is expected to surpass 200 billion dollars by 2025, with wireless sensors being integral to this transformation. These sensors enable real-time data collection and monitoring, which facilitates predictive maintenance and minimizes downtime. Moreover, the ability to remotely monitor equipment and processes enhances decision-making capabilities, thereby driving the demand for wireless IoT sensors in manufacturing and logistics. This trend indicates a shift towards more connected and intelligent industrial environments.

Increased Investment in Smart Cities

The Wireless IoT Sensors Market is significantly impacted by increased investment in smart city initiatives. Governments and municipalities are allocating substantial resources to develop smart infrastructure, which relies heavily on wireless IoT sensors for data collection and management. The smart city market is anticipated to reach over 500 billion dollars by 2025, with wireless sensors playing a crucial role in traffic management, waste management, and energy efficiency. These sensors provide real-time data that informs city planning and resource allocation, enhancing urban living conditions. The emphasis on sustainability and efficient resource management further propels the demand for wireless IoT sensors in urban environments, indicating a transformative shift in how cities operate.

Advancements in Healthcare Monitoring

The Wireless IoT Sensors Market is witnessing advancements in healthcare monitoring technologies, which are reshaping patient care. The integration of wireless sensors in medical devices allows for continuous monitoring of patients' vital signs, leading to improved health outcomes. The healthcare IoT market is projected to reach approximately 100 billion dollars by 2025, with wireless sensors being a critical component. These sensors facilitate remote patient monitoring, enabling healthcare providers to track patients' conditions in real-time. This capability not only enhances patient engagement but also reduces hospital readmission rates, thereby driving the adoption of wireless IoT sensors in the healthcare sector. The ongoing innovations in sensor technology further bolster this trend.

Growing Demand for Smart Home Solutions

The Wireless IoT Sensors Market is experiencing a notable surge in demand for smart home solutions. As consumers increasingly seek convenience and energy efficiency, the integration of wireless sensors into home automation systems becomes essential. According to recent data, the smart home market is projected to reach a valuation of over 150 billion dollars by 2025, with wireless IoT sensors playing a pivotal role in this growth. These sensors facilitate real-time monitoring and control of home appliances, enhancing user experience and energy management. Furthermore, the proliferation of mobile applications that interface with these sensors allows for seamless user engagement, thereby driving the adoption of wireless IoT technologies in residential settings.