Rise of Smart Cities

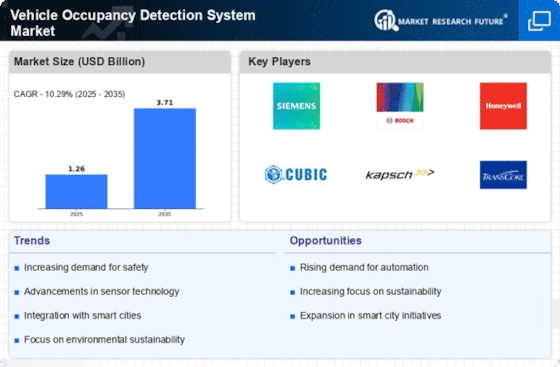

The ongoing development of smart cities is significantly influencing the Vehicle Occupancy Detection System Market. As urban areas evolve into interconnected ecosystems, the need for efficient transportation solutions becomes paramount. Vehicle occupancy detection systems play a vital role in this transformation by providing essential data that can optimize traffic flow and enhance public transportation services. The integration of these systems into smart city frameworks is expected to drive market growth, as municipalities seek to improve urban mobility and reduce congestion. Recent projections indicate that investments in smart city technologies are set to increase, which may further bolster the demand for advanced vehicle occupancy detection solutions. This trend highlights the potential for collaboration between technology providers and city planners to create more efficient urban environments.

Focus on Sustainability

Sustainability has emerged as a critical driver in the Vehicle Occupancy Detection System Market. As environmental concerns intensify, there is a growing emphasis on reducing carbon footprints and optimizing resource usage. Vehicle occupancy detection systems contribute to this goal by enabling more efficient use of transportation resources, thereby reducing congestion and emissions. For instance, systems that provide real-time occupancy data can facilitate carpooling and ridesharing, promoting a shift towards more sustainable travel options. Market data indicates that the demand for eco-friendly transportation solutions is on the rise, suggesting that companies focusing on sustainability in their vehicle occupancy systems may find increased opportunities for growth and collaboration with municipalities and organizations committed to environmental stewardship.

Integration of Advanced Technologies

The Vehicle Occupancy Detection System Market is experiencing a notable shift due to the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance the accuracy and efficiency of occupancy detection, allowing for real-time data analysis and improved decision-making. As cities increasingly adopt smart infrastructure, the demand for sophisticated vehicle occupancy systems is likely to rise. According to recent estimates, the market for AI-driven solutions in transportation is projected to grow significantly, indicating a robust future for the Vehicle Occupancy Detection System Market. This trend suggests that companies investing in these technologies may gain a competitive edge, as they can offer more reliable and innovative solutions to meet the evolving needs of urban mobility.

Government Initiatives and Regulations

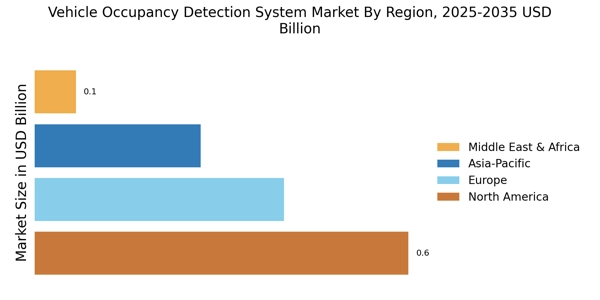

Government initiatives and regulations are increasingly shaping the Vehicle Occupancy Detection System Market. Many governments are implementing policies aimed at improving transportation efficiency and reducing environmental impact. These regulations often encourage the adoption of advanced vehicle occupancy detection systems as part of broader smart transportation strategies. For example, incentives for public transportation upgrades and investments in intelligent transportation systems are becoming more common. Market analysis suggests that regions with proactive government policies are likely to see accelerated growth in the vehicle occupancy detection sector. This regulatory support not only fosters innovation but also creates a favorable environment for companies to develop and deploy cutting-edge solutions that align with governmental objectives.

Increased Urbanization and Population Density

The trend of increased urbanization and population density is a significant driver for the Vehicle Occupancy Detection System Market. As more people migrate to urban areas, the demand for efficient transportation solutions intensifies. Vehicle occupancy detection systems can help manage this demand by providing insights into vehicle usage patterns and optimizing traffic management. Data indicates that urban areas are experiencing rapid growth, leading to heightened congestion and a pressing need for innovative solutions. Consequently, the market for vehicle occupancy detection systems is likely to expand as cities seek to implement technologies that enhance mobility and reduce traffic-related issues. This trend underscores the importance of developing systems that can adapt to the complexities of urban transportation networks.