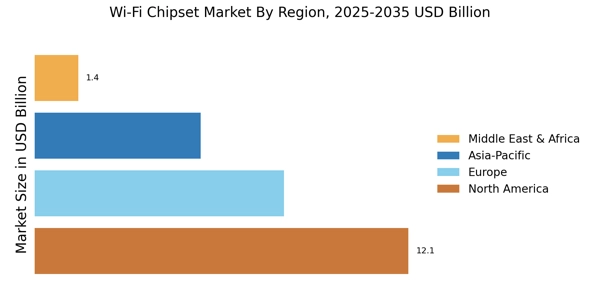

By Region, the study provides market insights into Europe, North America, Asia-Pacific, and the Rest of the World. The North American Wi-Fi chipset market is expected to grow at a significant CAGR during the study period, accounting for USD 9.87 billion in 2021, owing to widespread regional Internet of Things adoption (IoT). The increasing use of high-tech smart devices and consumer electronics and the growing use of wireless chipsets encourages further investment in the wireless chipset space. Further fueling the demand for Wi-Fi chipsets in the region is the trend toward industrial automation.

The region's reliance on wireless technology is also growing to provide favorable infrastructure to technology companies and other industries and guarantee a stable network across commercial and residential sectors. Furthermore, large wireless companies have a strong presence in North America, making it an important regional market for Wi-Fi chipset technology.

Moreover, the major countries covered in the market report include the United States, Germany, Canada, France, the United Kingdom, Italy, Spain, India, Japan, Australia, China, South Korea, and Brazil.

Figure 3: Wi-Fi Chipset Market SHARE BY REGION 2021 (%)

The European Wi-Fi chipset market is the world's second-largest owing to the growing demand for open-source software and the region's increased prevalence of data security. Smartphone adoption in the United Kingdom and Germany is expected to drive regional Wi-Fi semiconductor chipset market share during the assessment period. This expansion can be attributed to lower prices and advancements in smartphone technology. Additionally, the high consumption of Wi-Fi chipsets by businesses & enterprises, automotive companies, and smart devices, combined with the rising demand for Wi-Fi chipsets by IEEE standards, are driving the smartphone Wi-Fi chipset in Europe. Further, the U.K.

Wi-Fi chipset market held the largest market share, and the German Wi-Fi chipset market was the fastest-growing market in the European region.

The Asia Pacific Wi-Fi chipset market is expected to grow at the fastest CAGR during the forecast period, owing to the presence of many Wi-Fi chipset manufacturing companies and the use of Wi-Fi chipsets in finished products. In addition, it is anticipated that increased government adoption of public hotspots in developing nations like Japan, South Korea, China, Singapore, and India will drive the Wi-Fi device market demand during the forecasting years. As a result, China accounted for most of the Asia Pacific wireless chipset market. By IEEE standards, China will be the top country producing Wi-Fi chipsets in 2023.

In addition, the Asia-Pacific region's expanding adoption of wi-fi technology in education, healthcare, retail, and other sectors has significantly contributed to the market's expansion.