Advancements in Streaming Services

The multimedia chipset market is significantly influenced by the rapid advancements in streaming services. With platforms like Netflix and Hulu expanding their offerings, the demand for high-performance chipsets that can handle 4K and even 8K streaming is on the rise. In 2025, it is estimated that over 60% of households in the US will subscribe to at least one streaming service, necessitating the integration of powerful multimedia chipsets. This trend indicates a robust opportunity for growth within the multimedia chipset market, as companies innovate to meet the increasing expectations of consumers for seamless and high-quality streaming experiences.

Rising Demand for Smart Home Devices

The multimedia chipset market is significantly impacted by the rising demand for smart home devices. As consumers increasingly adopt smart technologies for home automation, the need for efficient and powerful multimedia chipsets becomes critical. In 2025, the smart home market is expected to reach $100 billion, with multimedia chipsets playing a vital role in enabling seamless connectivity and functionality. This trend suggests that the multimedia chipset market will continue to evolve, focusing on developing chipsets that support various smart home applications, from security systems to entertainment hubs, thereby enhancing the overall consumer experience.

Surge in Consumer Electronics Demand

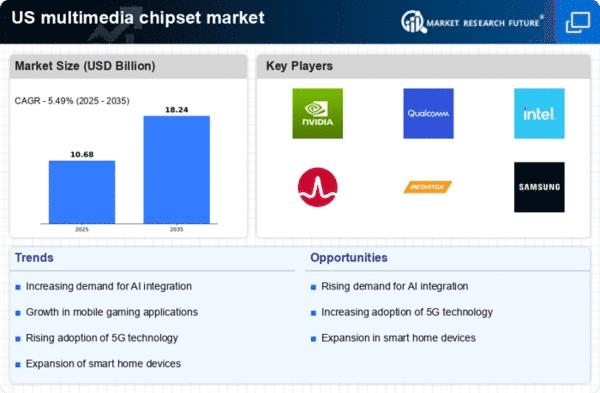

The multimedia chipset market experiences a notable surge in demand driven by the increasing consumption of consumer electronics. As households adopt smart devices, the need for advanced multimedia chipsets becomes apparent. In 2025, the market is projected to reach approximately $15 billion, reflecting a growth rate of around 10% annually. This growth is largely attributed to the proliferation of smartphones, tablets, and smart TVs, which require sophisticated chipsets to support high-definition video and audio processing. The multimedia chipset market is thus positioned to benefit from this consumer trend, as manufacturers strive to enhance device capabilities and user experiences.

Growth of Automotive Multimedia Systems

The multimedia chipset market is also benefiting from the growth of automotive multimedia systems. As vehicles become increasingly equipped with advanced infotainment systems, the demand for high-quality multimedia chipsets is expected to rise. In 2025, the automotive sector is projected to account for approximately 15% of the total multimedia chipset market. This shift indicates a growing trend towards integrating sophisticated audio and video systems in vehicles, enhancing the overall driving experience. The multimedia chipset market is thus likely to see increased collaboration with automotive manufacturers to develop tailored solutions that meet the unique requirements of modern vehicles.

Emergence of Augmented and Virtual Reality

The multimedia chipset market is poised for growth due to the emergence of augmented reality (AR) and virtual reality (VR) technologies. As applications in gaming, education, and training become more prevalent, the demand for specialized chipsets that can support these immersive experiences is likely to increase. By 2025, the AR and VR market is projected to exceed $200 billion, creating a substantial opportunity for the multimedia chipset market. Companies are investing in research and development to create chipsets that can deliver high frame rates and low latency, essential for a compelling user experience in AR and VR applications.