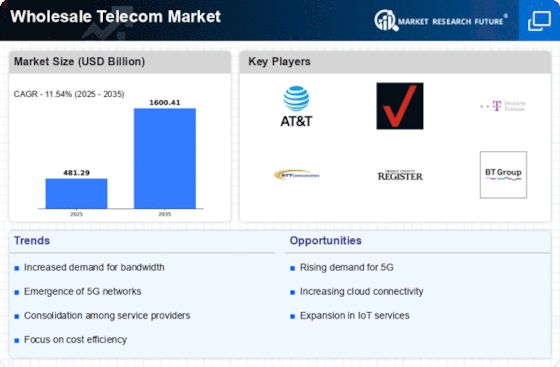

Expansion of 5G Networks

The rollout of 5G networks is transforming the Wholesale Telecom Market, as it enables faster data transmission and lower latency. This technological advancement is expected to facilitate the development of new applications, such as augmented reality and smart cities, which require high-speed connectivity. As of October 2025, several regions have made significant progress in deploying 5G infrastructure, with investments reaching billions of dollars. The expansion of 5G networks not only enhances service offerings for wholesale telecom providers but also drives demand for wholesale services as businesses seek to leverage this technology. Consequently, the Wholesale Telecom Market is likely to witness increased competition and innovation as providers strive to meet the evolving needs of their customers.

Increased Demand for Bandwidth

The Wholesale Telecom Market experiences a notable surge in demand for bandwidth, driven by the proliferation of data-intensive applications and services. As businesses and consumers increasingly rely on high-speed internet for activities such as streaming, gaming, and remote work, the need for robust bandwidth solutions becomes paramount. According to recent data, the global demand for bandwidth is projected to grow at a compound annual growth rate of over 20% in the coming years. This trend compels wholesale telecom providers to enhance their infrastructure and expand their offerings, thereby creating opportunities for growth within the Wholesale Telecom Market. The ability to provide scalable and flexible bandwidth solutions is likely to be a key differentiator among competitors.

Emergence of New Business Models

The Wholesale Telecom Market is witnessing the emergence of innovative business models that cater to the changing needs of customers. Traditional pricing structures are being challenged by new approaches such as pay-as-you-go and subscription-based models, which offer greater flexibility and cost-effectiveness. As businesses seek to optimize their telecom expenditures, wholesale providers are adapting their offerings to align with these preferences. This shift is likely to drive competition among providers, as they strive to attract and retain customers in a rapidly evolving market. Furthermore, the adoption of digital platforms for service delivery and customer engagement is enhancing the overall customer experience within the Wholesale Telecom Market, potentially leading to increased customer loyalty and satisfaction.

Regulatory Changes and Compliance

The Wholesale Telecom Market is subject to evolving regulatory frameworks that can impact market dynamics. Governments and regulatory bodies are increasingly focusing on issues such as data privacy, cybersecurity, and fair competition. Compliance with these regulations is essential for wholesale telecom providers to maintain their market position and avoid potential penalties. As of October 2025, many countries are implementing stricter regulations regarding data protection, which may require wholesale telecom companies to invest in enhanced security measures and compliance protocols. This regulatory landscape presents both challenges and opportunities, as providers that proactively adapt to these changes may gain a competitive edge in the Wholesale Telecom Market.

Rising Adoption of Internet of Things (IoT)

The Wholesale Telecom Market is significantly influenced by the rising adoption of Internet of Things (IoT) devices across various sectors. As industries such as manufacturing, healthcare, and transportation increasingly integrate IoT solutions, the demand for reliable and scalable connectivity solutions intensifies. It is estimated that the number of connected IoT devices will exceed 30 billion by 2030, creating a substantial market for wholesale telecom services. This trend compels wholesale telecom providers to develop specialized offerings tailored to IoT applications, including low-power wide-area networks (LPWAN) and edge computing solutions. The ability to support diverse IoT use cases positions the Wholesale Telecom Market for sustained growth and innovation.