Market Share

Wholesale Telecom Market Share Analysis

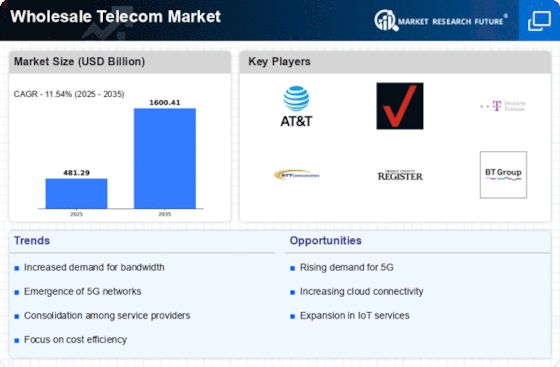

The Wholesale telecom Market is a dynamic and cutthroat industry in which market proportion situating processes are expected to be a crucial element in identifying the progress of telecom groups. In this profoundly interconnected and quickly developing scene, corporations endeavor to lay out fundamental regions of energy via viable situating processes. One noticeable system used by telecom businesses is separation. This consists of offering top-notch and unmistakable administrations that set them apart from contenders. Whether it is through a nation of artwork innovation, unmatched enterprise foundation, or creative comparing models, groups want to make an incentive that requests a selected goal market. Via cutting out a uniqueness, they draw in clients seeking out precise administrations in addition to assembling a logo character that encourages customer dependability. Cooperation and agencies likewise anticipate a crucial element in marketplace share situated within the wholesale telecom market. Key unions with other telecom directors, innovation providers, or even current accomplices can open new doors for improvement. By making use of every different asset and property, agencies can enhance their management contributions and market reach. In the Wholesale telecom Market, the topographical situation is another key concept. Organizations decisively pick their goal districts in mild of factors like population thickness, monetary development, and administrative weather. By summing up unambiguous geographic regions, telecom suppliers can match their administrations to satisfy the incredible needs of these markets, obtaining a top hand. This technique lets organizations install an awesome basis for themselves as nearby experts, building acceptance as true with and validity amongst customers in the locales. Also, innovation reception and improvement are critical parts of market share situating techniques. Remaining at the front line of mechanical headways empowers telecom agencies to offer the kingdom of the artwork arrangements and attract clients looking for the maximum current and maximum solid administrations. Whether it's the execution of 5G organizations, IoT mixture, or excessive degree network protection measures, ultimate robotically extensive guarantees that agencies live severely in a fast-growing enterprise. Client-driven structures likewise anticipate an essential component in WholeMarket's situation. By understanding the specific requirements and tendencies of their ideal interest organization, corporations can tailor their administrations and consumer service to offer an uncommon stumble. This consumer-pushed method facilitates patron renovation as well as attracts new clients through verbal exchange and notoriety building.

Leave a Comment