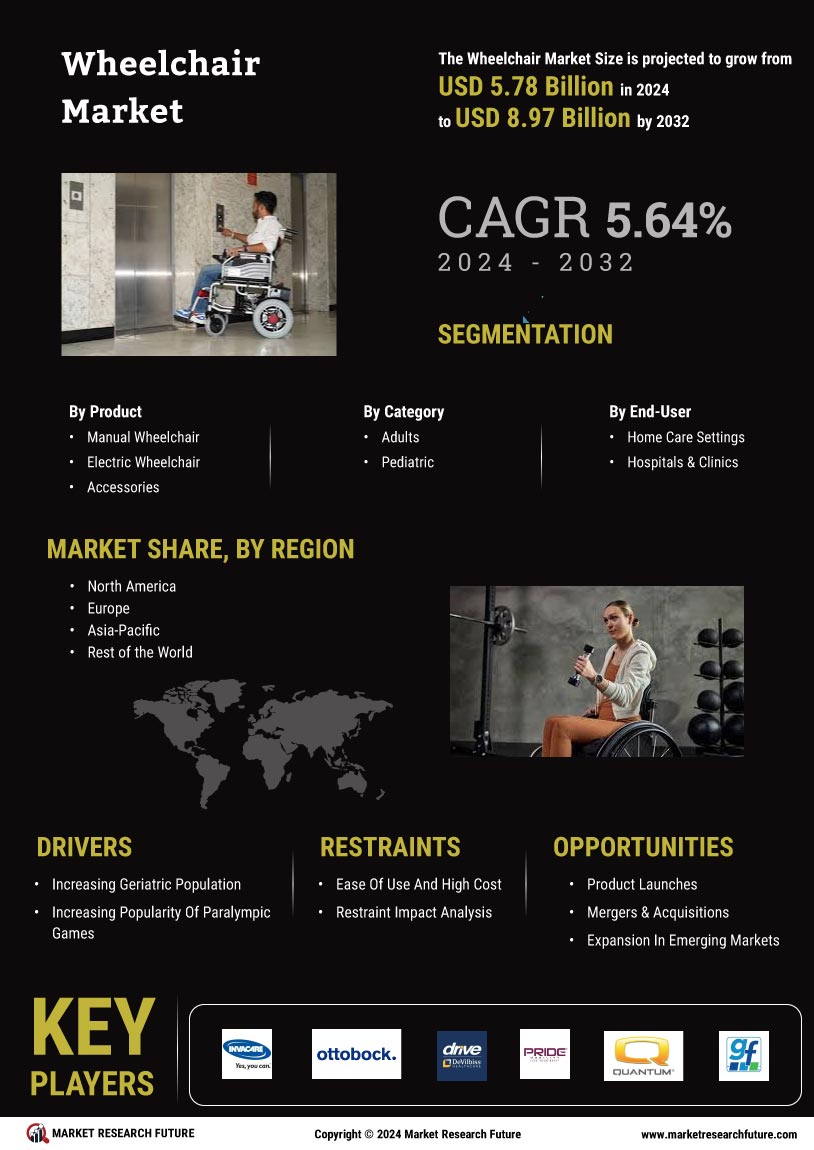

Aging Population

The increasing number of elderly individuals worldwide is a primary driver of the Wheelchair Market. As people age, mobility issues become more prevalent, leading to a higher demand for wheelchairs. According to recent statistics, the population aged 65 and older is projected to reach 1.5 billion by 2050, which suggests a substantial market opportunity for wheelchair manufacturers. This demographic shift necessitates the development of innovative and comfortable mobility solutions tailored to the needs of older adults. Furthermore, the aging population often requires additional support services, which may further stimulate growth in the Wheelchair Market as families seek comprehensive mobility solutions for their loved ones.

Rising Disability Rates

The prevalence of disabilities is on the rise, which significantly impacts the Wheelchair Market. Factors such as increased awareness, better diagnostic tools, and improved healthcare access contribute to this trend. Recent data indicates that approximately 15% of the world's population lives with some form of disability, which translates to a substantial market for mobility aids. This growing demographic is likely to drive demand for various types of wheelchairs, including manual, powered, and specialized models. As the need for mobility solutions expands, manufacturers in the Wheelchair Market are expected to innovate and diversify their product offerings to cater to a wider range of disabilities.

Technological Innovations

Technological advancements are reshaping the Wheelchair Market, leading to the development of smarter and more efficient mobility solutions. Innovations such as electric wheelchairs, smart controls, and advanced materials are enhancing user experience and accessibility. For instance, the integration of IoT technology allows for real-time monitoring of wheelchair performance and user health metrics. This trend is likely to attract a tech-savvy consumer base, particularly among younger individuals with disabilities. Moreover, the increasing focus on user-friendly designs and enhanced functionality may drive competition among manufacturers, ultimately benefiting consumers in the Wheelchair Market.

Increased Awareness and Advocacy

There is a growing awareness and advocacy for the rights of individuals with disabilities, which is positively influencing the Wheelchair Market. Non-profit organizations and community groups are actively promoting the importance of mobility aids, leading to a cultural shift in how society views disability. This heightened awareness is likely to encourage more individuals to seek out wheelchairs, thereby expanding the market. Furthermore, campaigns aimed at reducing stigma and promoting inclusivity may lead to increased demand for stylish and functional wheelchair designs. As societal attitudes continue to evolve, the Wheelchair Market is expected to benefit from a broader acceptance and understanding of the needs of individuals with mobility challenges.

Government Initiatives and Funding

Government policies and funding initiatives play a crucial role in shaping the Wheelchair Market. Many countries are implementing programs aimed at improving accessibility for individuals with disabilities, which often includes financial support for mobility aids. For example, various healthcare systems provide subsidies or reimbursements for wheelchair purchases, making them more affordable for consumers. This financial assistance is likely to increase the adoption of wheelchairs, particularly among low-income populations. Additionally, advocacy for disability rights and accessibility legislation may further bolster the Wheelchair Market by promoting awareness and encouraging manufacturers to develop compliant products.