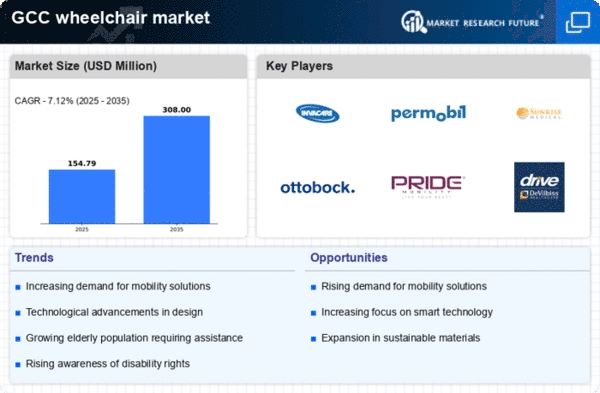

Aging Population and Disability Rates

The increasing aging population in the GCC region is a crucial driver for the wheelchair market. As life expectancy rises, the prevalence of age-related disabilities also escalates. According to recent statistics, approximately 15% of the population in GCC countries is aged 60 and above, leading to a heightened demand for mobility aids. This demographic shift necessitates the availability of various wheelchair options to cater to the diverse needs of older adults. Furthermore, the rising incidence of disabilities due to chronic diseases among the elderly population further propels the wheelchair market. The combination of these factors indicates a sustained growth trajectory for the industry, as more individuals seek mobility solutions to enhance their quality of life.

Healthcare Infrastructure Development

The ongoing enhancement of healthcare infrastructure in the GCC region significantly influences the wheelchair market. Governments are investing heavily in healthcare facilities, aiming to provide better services to their citizens. For instance, the GCC healthcare expenditure is projected to reach $100 billion by 2025, which includes the procurement of medical equipment such as wheelchairs. Improved healthcare facilities not only increase accessibility to mobility aids but also promote awareness regarding the importance of mobility solutions for rehabilitation. This development is likely to create a favorable environment for the wheelchair market, as hospitals and rehabilitation centers expand their offerings to include a wider range of wheelchair options.

Rising Awareness of Disability Rights

The growing awareness of disability rights in the GCC region is a pivotal driver for the wheelchair market. Advocacy groups and governmental bodies are increasingly promoting inclusivity and accessibility for individuals with disabilities. This cultural shift is leading to enhanced public awareness regarding the rights of disabled individuals, which in turn drives demand for mobility aids. As more people recognize the importance of providing equal opportunities for those with disabilities, the market for wheelchairs is likely to expand. Additionally, the implementation of policies aimed at improving accessibility in public spaces further supports the growth of the wheelchair market, as it encourages manufacturers to innovate and offer more diverse products.

Technological Innovations in Wheelchair Design

Technological advancements in wheelchair design are transforming the wheelchair market in the GCC. Innovations such as lightweight materials, smart wheelchairs, and enhanced maneuverability are becoming increasingly prevalent. The introduction of electric and automated wheelchairs is particularly noteworthy, as these products cater to a broader range of users, including those with severe mobility impairments. The market for electric wheelchairs is expected to grow at a CAGR of 8% over the next five years, reflecting the rising demand for advanced mobility solutions. These technological innovations not only improve user experience but also attract a younger demographic, thereby expanding the market's consumer base.

Economic Growth and Increased Disposable Income

The economic growth experienced in the GCC region is a significant driver for the wheelchair market. As economies diversify and develop, disposable incomes are rising, allowing more individuals to invest in mobility aids. The GCC countries have seen a steady increase in GDP, with projections indicating a growth rate of around 3% annually. This economic prosperity enables families to prioritize health and mobility, leading to increased purchases of wheelchairs. Moreover, as the standard of living improves, there is a growing expectation for high-quality, comfortable, and stylish mobility solutions. This trend suggests that the wheelchair market will continue to thrive as consumers seek products that not only meet their functional needs but also align with their lifestyle preferences.