Rising Disability Awareness

The increasing awareness regarding disabilities in Japan appears to be a pivotal driver for the wheelchair market. As societal attitudes evolve, there is a growing recognition of the need for accessible mobility solutions. This shift is likely to enhance the demand for wheelchairs, as more individuals seek to improve their quality of life. In 2025, the market is projected to grow by approximately 8% annually, reflecting this heightened awareness. Furthermore, educational campaigns and advocacy efforts are fostering a more inclusive environment, which may lead to increased sales of various wheelchair types, including manual and powered options. The wheelchair market is thus positioned to benefit from this cultural transformation, as it aligns with the broader goals of inclusivity and accessibility for all citizens.

Aging Population and Longevity

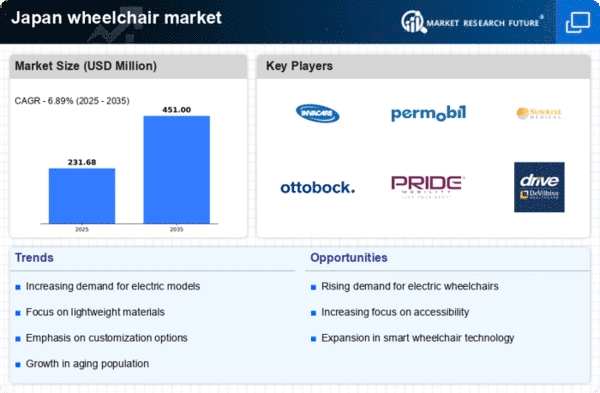

Japan's aging population is a critical driver for the wheelchair market. As the demographic landscape shifts, the number of elderly individuals requiring mobility assistance is expected to rise significantly. By 2025, it is estimated that over 30% of the population will be aged 65 and older, creating a substantial demand for wheelchairs. This demographic trend suggests that the market will likely expand, with a focus on products tailored to the needs of older adults. Furthermore, the increasing life expectancy may lead to a greater emphasis on maintaining mobility and independence among seniors. The wheelchair market is thus poised for growth, as it adapts to the evolving needs of an aging society.

Healthcare System Enhancements

Improvements in Japan's healthcare system are likely to serve as a crucial driver for the wheelchair market. With an emphasis on patient-centered care, healthcare providers are increasingly recognizing the importance of mobility aids in rehabilitation and recovery. This focus may lead to higher prescriptions and recommendations for wheelchairs, particularly for elderly patients. In 2025, it is anticipated that healthcare expenditures related to mobility aids will rise by 5%, reflecting the growing integration of wheelchairs into treatment plans. Furthermore, partnerships between healthcare institutions and wheelchair manufacturers could facilitate better access to these products. The wheelchair market stands to gain from these enhancements, as they align with the broader objectives of improving patient outcomes and quality of life.

Innovative Product Development

Innovation within the wheelchair market is a significant driver, as manufacturers in Japan are increasingly focusing on developing advanced products. The integration of smart technology, such as IoT features and enhanced ergonomics, is becoming more prevalent. This trend is likely to attract tech-savvy consumers who prioritize functionality and comfort. In 2025, the market for electric wheelchairs is expected to account for over 30% of total sales, indicating a shift towards more sophisticated mobility solutions. Additionally, the introduction of lightweight materials and customizable designs may further stimulate consumer interest. The wheelchair market is thus witnessing a transformation, where innovation not only meets the needs of users but also enhances their overall experience.

Urbanization and Infrastructure Development

The ongoing urbanization in Japan is likely to impact the wheelchair market positively. As cities expand and infrastructure develops, there is a growing emphasis on creating accessible environments. This trend may lead to increased demand for wheelchairs, as more individuals require mobility solutions that accommodate urban living. In 2025, it is projected that the demand for wheelchairs in urban areas will increase by 10%, driven by improved public transport systems and accessible facilities. Additionally, government initiatives aimed at enhancing urban accessibility may further stimulate market growth. The wheelchair market is thus positioned to benefit from these developments, as they align with the needs of a more mobile and inclusive society.