Product Innovation

Innovation within the Global Water Enhancer Market Industry plays a crucial role in attracting consumers. Manufacturers are increasingly developing new flavors, formulations, and packaging to meet diverse consumer preferences. For instance, the introduction of natural and organic ingredients has resonated well with environmentally conscious buyers. This focus on innovation is expected to drive market growth, with projections indicating a rise to 10.6 USD Billion by 2035. As companies invest in research and development, the variety of offerings is likely to expand, catering to a broader audience and enhancing market competitiveness.

Health Consciousness

The increasing awareness of health and wellness among consumers appears to be a primary driver of the Global Water Enhancer Market Industry. As individuals seek healthier lifestyle choices, the demand for flavored water alternatives has surged. This trend is particularly evident in regions where consumers are moving away from sugary beverages. In 2024, the market is projected to reach 3.53 USD Billion, reflecting a growing preference for products that enhance hydration without added calories. This shift indicates a potential for sustained growth, as health-conscious consumers are likely to continue prioritizing functional beverages.

Sustainability Trends

Sustainability is increasingly becoming a focal point within the Global Water Enhancer Market Industry. Consumers are showing a preference for products that utilize eco-friendly packaging and sustainable sourcing practices. This trend is indicative of a broader societal shift towards environmental responsibility. Companies that adopt sustainable practices may gain a competitive edge, appealing to the growing demographic of environmentally conscious consumers. As sustainability becomes a key purchasing criterion, the market is likely to see enhanced growth opportunities, particularly as consumers align their purchasing decisions with their values.

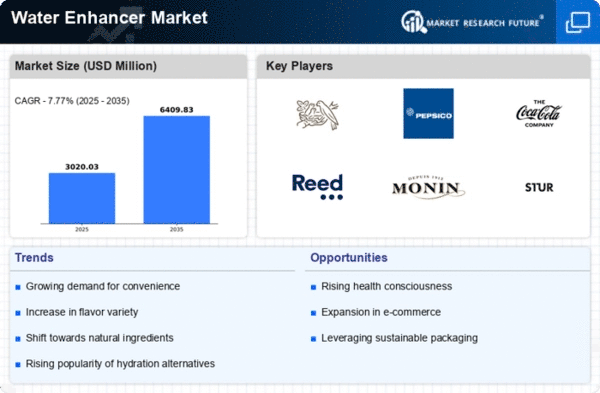

Market Growth Projections

The Global Water Enhancer Market Industry is poised for substantial growth, with projections indicating a market size of 3.53 USD Billion in 2024 and an anticipated increase to 10.6 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 10.5% from 2025 to 2035. Such figures reflect the increasing consumer demand for flavored and functional beverages, as well as the ongoing innovation within the industry. The market's expansion is likely to be driven by various factors, including health trends, product innovation, and enhanced distribution channels.

Convenience and Portability

The demand for convenience is a significant factor influencing the Global Water Enhancer Market Industry. Busy lifestyles have led consumers to seek portable and easy-to-use products that can enhance their hydration on the go. Water enhancers, often available in convenient packaging such as single-serve sachets or bottles, align well with this trend. This convenience factor is likely to contribute to the projected compound annual growth rate of 10.5% from 2025 to 2035. As urbanization continues to rise, the need for accessible hydration solutions is expected to bolster market growth.

Global Distribution Channels

The expansion of global distribution channels is a vital driver for the Global Water Enhancer Market Industry. As e-commerce continues to flourish, consumers have greater access to a variety of water enhancer products. Retailers are increasingly stocking these items, both online and in physical stores, making them more accessible to a wider audience. This increased availability is expected to contribute to the market's growth trajectory, with projections suggesting a rise to 10.6 USD Billion by 2035. Enhanced distribution strategies may facilitate consumer engagement and drive sales, ultimately benefiting manufacturers.