Market Analysis

In-depth Analysis of Water Enhancer Market Industry Landscape

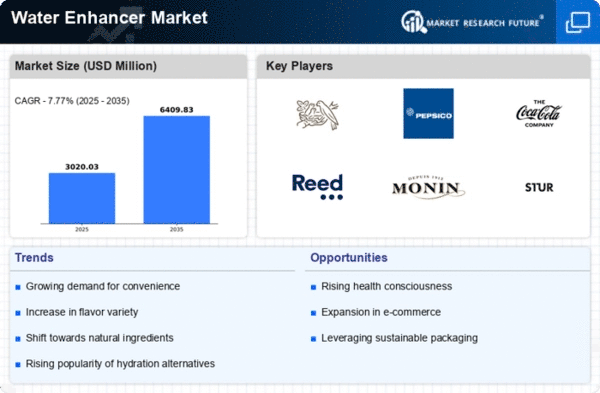

The Water Enhancer market has experienced significant trends and shifts in recent years, reflecting the dynamic preferences of consumers and the growing emphasis on health and wellness. One prominent trend driving the market is the increasing demand for flavored and enhanced water options as an alternative to traditional sugary beverages. With a rising awareness of the negative impact of excessive sugar consumption on health, consumers are seeking healthier alternatives, and water enhancers provide a convenient solution.

Another noteworthy trend is the surge in the popularity of natural and organic ingredients in water enhancers. Consumers are becoming more conscious of the ingredients they consume, leading to a preference for products that are free from artificial additives and preservatives. This shift aligns with the broader movement toward clean label products, where transparency and natural ingredients are valued by health-conscious consumers.

The market has also witnessed a growing interest in functional water enhancers that offer additional benefits beyond flavor. Functional ingredients such as vitamins, minerals, electrolytes, and antioxidants are being incorporated into water enhancers to cater to consumers looking for a hydrating beverage with added health benefits. This aligns with the broader trend of functional beverages gaining traction in the market.

Convenience plays a crucial role in shaping market trends, and the water enhancer market is no exception. Busy lifestyles and on-the-go consumption patterns have driven the demand for portable and easy-to-use water enhancer products. Single-serve packaging and pocket-sized bottles have become popular choices, allowing consumers to customize their water wherever they are, whether at the gym, office, or while traveling.

In terms of flavor preferences, a diverse range of options has emerged to cater to the varied tastes of consumers. While classic fruit flavors remain popular, there is an increasing demand for unique and exotic flavors. Companies in the water enhancer market are innovating to introduce novel flavor combinations, often inspired by global culinary trends, to capture consumer interest and differentiate their products in a competitive landscape.

Moreover, sustainability is a growing concern, and consumers are seeking eco-friendly packaging options. The market has responded with an increase in the availability of water enhancers packaged in recyclable materials, with some companies adopting sustainable practices in their production processes. This reflects a broader industry shift towards environmental consciousness and corporate responsibility.

Digital and social media platforms have played a pivotal role in shaping consumer perceptions and driving awareness about water enhancers. Marketing strategies that leverage these platforms to showcase product benefits, usage scenarios, and customer testimonials have become instrumental in influencing purchasing decisions. The digital space has become a key battleground for brands vying for consumer attention and loyalty.

Leave a Comment