Market Trends

Key Emerging Trends in the Water Enhancer Market

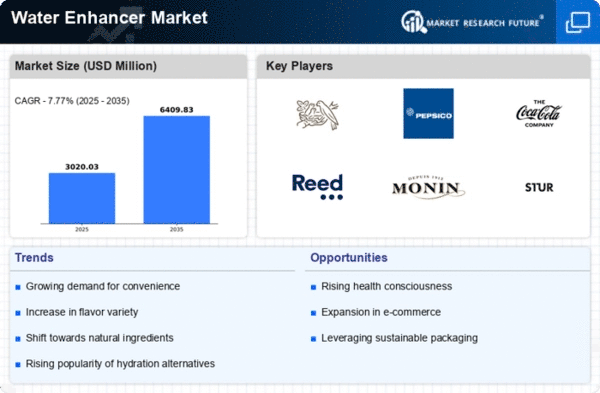

The water enhancer market has witnessed significant dynamics driven by evolving consumer preferences, health consciousness, and the demand for convenient hydration solutions. In recent years, there has been a notable shift in consumer behavior towards healthier beverage choices, prompting the rise of the water enhancer market. These products, often in liquid or powder form, are designed to add flavor, vitamins, and other functional ingredients to water, transforming it into a more enticing and nutritious option.

One key driver of market dynamics is the increasing awareness of the health benefits associated with adequate hydration. As consumers become more health-conscious, they are seeking alternatives to sugary and calorie-laden beverages. Water enhancers offer a solution by providing flavor without the drawbacks of added sugars or artificial sweeteners. This has led to a surge in demand for water enhancers as individuals look for ways to make water consumption more enjoyable while maintaining a healthy lifestyle.

Moreover, the convenience factor plays a pivotal role in shaping the dynamics of the water enhancer market. Busy lifestyles and on-the-go consumption patterns have fueled the demand for portable and easily customizable hydration options. Water enhancers cater to this need by offering a quick and efficient way to personalize the taste of water anytime, anywhere. The compact and portable nature of these products aligns with the fast-paced lifestyles of modern consumers, contributing to the market's growth.

Flavor innovation is another crucial aspect of market dynamics in the water enhancer industry. Companies are continually introducing new and exotic flavors to captivate consumer taste buds and differentiate their products. From traditional fruit flavors to unique combinations, the variety of options available in the market ensures that consumers can find a water enhancer that suits their preferences. This constant innovation not only attracts new customers but also fosters brand loyalty among existing ones, driving sustained market growth.

The competitive landscape is evolving as both established players and new entrants vie for a share of the expanding water enhancer market. This has led to increased marketing efforts and promotional activities to create brand awareness and communicate the unique selling propositions of different products. As a result, consumers are now presented with a plethora of choices, contributing to the overall dynamism of the market.

Regulatory considerations and the growing emphasis on natural and clean label products also shape market dynamics. With a rising focus on health and wellness, consumers are scrutinizing product labels for natural ingredients and avoiding artificial additives. Manufacturers in the water enhancer market are responding to this trend by formulating products with clean and transparent ingredient lists. Adherence to stringent regulatory standards has become a competitive advantage, influencing consumer trust and purchase decisions.

Leave a Comment