Rising E-commerce Demand

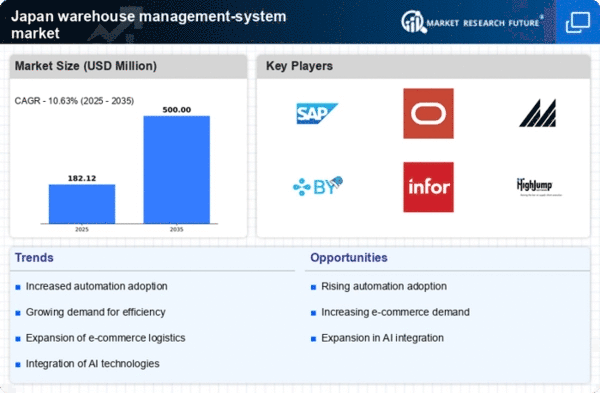

The surge in e-commerce activities in Japan is driving the warehouse management-system market. As online shopping continues to gain traction, businesses are compelled to enhance their logistics and inventory management capabilities. This shift necessitates the adoption of advanced warehouse management systems to streamline operations, improve order fulfillment, and manage inventory more effectively. According to recent data, the e-commerce sector in Japan is projected to grow at a CAGR of approximately 10% over the next few years, further emphasizing the need for efficient warehouse solutions. Consequently, companies are increasingly investing in warehouse management systems to meet the rising consumer expectations for faster delivery and improved service quality.

Technological Advancements in Logistics

Technological innovations are significantly influencing the warehouse management-system market in Japan. The integration of technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) is enhancing operational efficiency and accuracy in warehouse management. These advancements enable real-time tracking of inventory, predictive analytics for demand forecasting, and automation of routine tasks. As a result, businesses are likely to experience reduced operational costs and improved productivity. The Japanese logistics sector is expected to invest over $10 billion in technology upgrades by 2026, indicating a strong trend towards adopting sophisticated warehouse management systems to leverage these technological benefits.

Growing Focus on Supply Chain Resilience

In the context of Japan's warehouse management-system market, there is a growing emphasis on supply chain resilience. Recent disruptions in global supply chains have highlighted the need for businesses to develop more robust and flexible logistics strategies. Companies are increasingly investing in warehouse management systems that provide enhanced visibility and control over their supply chains. This trend is likely to lead to a more proactive approach in inventory management and distribution processes. As organizations strive to build resilience against potential disruptions, the demand for advanced warehouse management solutions is expected to rise, reflecting a strategic shift in how logistics operations are managed.

Labor Shortages and Workforce Challenges

Japan is currently facing significant labor shortages, particularly in the logistics and warehousing sectors. This demographic challenge is compelling companies to seek automation solutions to mitigate the impact of reduced workforce availability. The warehouse management-system market is likely to benefit from this trend, as businesses look to implement systems that can automate various processes, thereby reducing reliance on manual labor. It is estimated that the logistics industry in Japan could see a workforce decline of up to 20% by 2030, prompting a shift towards more automated and efficient warehouse management solutions to maintain operational effectiveness.

Regulatory Compliance and Safety Standards

The warehouse management-system market in Japan is also influenced by stringent regulatory compliance and safety standards. Companies are required to adhere to various regulations concerning workplace safety, environmental impact, and data protection. As these regulations become more complex, businesses are increasingly turning to advanced warehouse management systems to ensure compliance and mitigate risks. The investment in such systems is expected to rise, as organizations seek to avoid penalties and enhance their operational integrity. The Japanese government has been actively promoting initiatives to improve safety standards in logistics, which further drives the demand for sophisticated warehouse management solutions.