Labor Shortages

Labor shortages in the logistics sector are significantly impacting the warehouse management-system market. With a growing number of job vacancies and a limited workforce, companies are compelled to adopt automated solutions to maintain productivity. In 2025, the US is expected to face a shortage of approximately 1.5 million workers in the logistics industry. This situation drives the demand for warehouse management systems that can automate various processes, from inventory tracking to order fulfillment. By reducing reliance on manual labor, businesses can mitigate the effects of labor shortages and ensure operational continuity. Consequently, the warehouse management system market is likely to expand as organizations seek to implement solutions that address these workforce challenges.

Regulatory Compliance

Regulatory compliance is an essential driver for the warehouse management-system market. As businesses navigate complex regulations related to safety, environmental standards, and data protection, the need for robust management systems becomes apparent. In 2025, compliance-related costs are projected to account for approximately 5% of total operational expenses for many companies. Warehouse management systems can facilitate adherence to these regulations by providing accurate tracking, reporting, and documentation capabilities. This not only helps organizations avoid penalties but also enhances their reputation in the market. As compliance requirements continue to evolve, the warehouse management system market is expected to grow, driven by the necessity for businesses to implement systems that ensure regulatory adherence.

Rising E-Commerce Demand

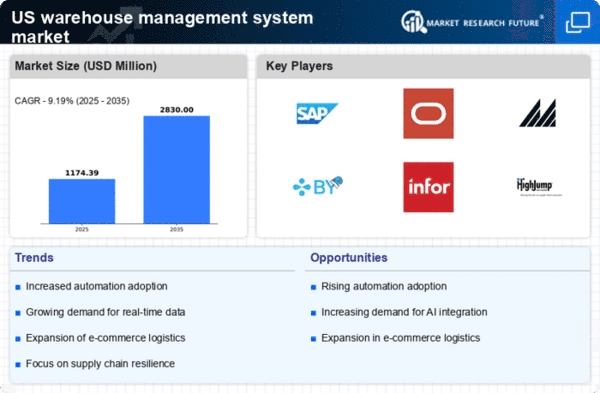

The surge in e-commerce activities is a pivotal driver for the warehouse management-system market. As online shopping continues to gain traction, businesses are compelled to enhance their logistics and inventory management capabilities. In 2025, e-commerce sales in the US are projected to reach approximately $1 trillion, necessitating efficient warehouse operations. This demand for speed and accuracy in order fulfillment drives the adoption of advanced warehouse management systems. Companies are increasingly investing in technology to streamline their supply chains, reduce operational costs, and improve customer satisfaction. The warehouse management-system market is thus experiencing significant growth, as organizations seek to optimize their warehousing processes to meet the evolving demands of consumers.

Technological Advancements

Technological innovations play a crucial role in shaping the warehouse management-system market. The integration of artificial intelligence (AI), machine learning, and the Internet of Things (IoT) into warehouse operations enhances efficiency and accuracy. For instance, AI-driven analytics can optimize inventory levels, while IoT devices facilitate real-time tracking of goods. In 2025, it is estimated that the adoption of these technologies could lead to a reduction in operational costs by up to 20%. As businesses strive to remain competitive, the implementation of cutting-edge technologies in warehouse management systems becomes increasingly vital. This trend indicates a robust growth trajectory for the warehouse management-system market, as organizations leverage technology to improve their operational capabilities.

Increased Focus on Supply Chain Resilience

The emphasis on supply chain resilience is emerging as a significant driver for the warehouse management-system market. Recent disruptions have highlighted the vulnerabilities within supply chains, prompting organizations to invest in systems that enhance flexibility and responsiveness. In 2025, it is anticipated that companies will allocate up to 10% of their logistics budgets to improve supply chain resilience. Warehouse management systems play a critical role in this endeavor by enabling real-time visibility, inventory optimization, and efficient resource allocation. As businesses strive to build more resilient supply chains, the demand for advanced warehouse management solutions is likely to increase, thereby propelling growth in the warehouse management-system market.