Rising E-commerce Demand

The surge in e-commerce activities in Brazil is driving the warehouse management system market. As online shopping becomes increasingly popular, businesses are compelled to enhance their logistics and inventory management capabilities. This trend is reflected in the growth of e-commerce sales, which reached approximately $30 billion in 2025, indicating a robust demand for efficient warehousing solutions. Companies are investing in advanced warehouse management systems to streamline operations, reduce order fulfillment times, and improve customer satisfaction. The need for real-time inventory tracking and efficient order processing is paramount, as consumers expect faster delivery times. Consequently, the warehouse management-system market is likely to expand significantly to accommodate the evolving needs of e-commerce businesses in Brazil.

Regulatory Compliance and Standards

The warehouse management-system market in Brazil is significantly influenced by regulatory compliance and industry standards. Companies are required to adhere to various regulations concerning safety, environmental impact, and operational efficiency. Compliance with these regulations necessitates the implementation of robust warehouse management systems that can ensure accurate reporting and tracking of inventory. For example, adherence to the National Health Surveillance Agency (ANVISA) regulations is critical for businesses in the pharmaceutical sector. As regulatory scrutiny intensifies, the demand for warehouse management systems that facilitate compliance is expected to rise. This trend indicates a growing market opportunity for providers of warehouse management solutions that can help businesses navigate complex regulatory landscapes.

Growing Investment in Infrastructure

Brazil's ongoing investment in infrastructure development is positively impacting the warehouse management-system market. The government has been focusing on improving transportation networks, including roads, ports, and airports, which facilitates smoother logistics operations. Enhanced infrastructure reduces transit times and costs, thereby increasing the efficiency of warehouse operations. As a result, businesses are more inclined to invest in advanced warehouse management systems that can optimize their logistics processes. The Brazilian government allocated approximately $10 billion for infrastructure projects in 2025, indicating a commitment to enhancing the logistics sector. This investment is expected to drive the growth of the warehouse management-system market as companies seek to capitalize on improved infrastructure.

Technological Advancements in Logistics

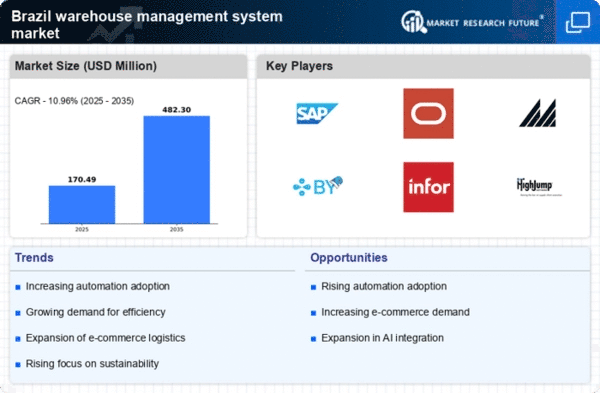

Technological innovations are reshaping the logistics landscape in Brazil, thereby influencing the warehouse management-system market. The integration of technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) is enhancing operational efficiency and accuracy in warehouse management. For instance, AI-driven analytics can optimize inventory levels and predict demand trends, which is crucial for businesses aiming to minimize costs and maximize service levels. The Brazilian logistics sector is projected to grow at a CAGR of 7% from 2025 to 2030, further emphasizing the need for sophisticated warehouse management systems that can leverage these technologies. As companies seek to remain competitive, the adoption of advanced warehouse management solutions is becoming increasingly vital.

Increased Focus on Supply Chain Resilience

The emphasis on supply chain resilience is becoming a pivotal driver for the warehouse management-system market in Brazil. Businesses are increasingly recognizing the importance of having flexible and responsive supply chains to mitigate risks associated with disruptions. This realization has led to investments in warehouse management systems that enhance visibility and control over inventory and logistics. According to recent studies, companies that adopt resilient supply chain practices can reduce operational costs by up to 20%. As Brazilian businesses strive to build more resilient supply chains, the demand for advanced warehouse management solutions is likely to grow, enabling them to respond swiftly to market changes and disruptions.