Expansion of Industry 4.0

The ongoing expansion of Industry 4.0 significantly influences the Global Virtual Engineering Market Industry. As manufacturing processes become increasingly digitized and interconnected, the need for virtual engineering solutions grows. Industry 4.0 emphasizes automation, data exchange, and smart manufacturing, all of which benefit from virtual engineering methodologies. For example, the integration of the Internet of Things (IoT) with virtual engineering allows for real-time monitoring and optimization of production processes. This synergy is expected to drive market growth, as organizations seek to leverage virtual engineering to enhance operational efficiency and innovation.

Market Growth Projections

The Global Virtual Engineering Market Industry is poised for remarkable growth, with projections indicating a rise from 792.1 USD Million in 2024 to 4015.5 USD Million by 2035. This trajectory suggests a robust CAGR of 15.9% from 2025 to 2035, reflecting the increasing integration of virtual engineering across various sectors. The growth is driven by factors such as technological advancements, cost efficiency, and sustainability initiatives. As industries continue to evolve and adapt to new challenges, the demand for virtual engineering solutions is expected to expand, solidifying its role as a cornerstone of modern engineering practices.

Technological Advancements

The Global Virtual Engineering Market Industry is propelled by rapid technological advancements in simulation and modeling tools. Innovations in software and hardware, such as high-performance computing and artificial intelligence, enhance the capabilities of virtual engineering. These technologies enable engineers to create more accurate models and simulations, leading to improved product designs and reduced time-to-market. For instance, the integration of AI in design processes allows for predictive analytics, which can optimize engineering workflows. As a result, the market is projected to reach 792.1 USD Million in 2024, reflecting the growing reliance on advanced technologies in engineering practices.

Growing Focus on Sustainability

Sustainability is becoming a pivotal concern within the Global Virtual Engineering Market Industry. As industries face increasing pressure to reduce their carbon footprints, virtual engineering offers a pathway to more sustainable practices. By enabling virtual testing and simulation, companies can minimize resource consumption and waste generation during the product development phase. This approach aligns with global sustainability goals and regulations, making virtual engineering an attractive option for environmentally conscious organizations. The industry's growth trajectory, with a projected CAGR of 15.9% from 2025 to 2035, indicates a strong alignment between virtual engineering and sustainability initiatives.

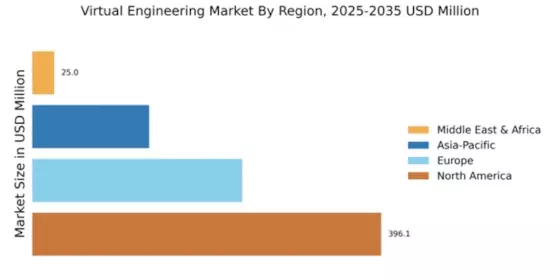

Rising Adoption in Emerging Markets

Emerging markets are witnessing a notable increase in the adoption of virtual engineering solutions, thereby driving the Global Virtual Engineering Market Industry. Countries in Asia-Pacific and Latin America are investing in advanced engineering technologies to enhance their manufacturing capabilities. This trend is fueled by the need for competitive advantage in global markets, prompting local companies to embrace virtual engineering for product development and innovation. As these regions continue to develop their industrial sectors, the market is likely to experience substantial growth, contributing to the overall expansion of the virtual engineering landscape.

Increased Demand for Cost Efficiency

Cost efficiency remains a critical driver for the Global Virtual Engineering Market Industry. Organizations are increasingly adopting virtual engineering solutions to minimize expenses associated with physical prototyping and testing. By utilizing virtual simulations, companies can identify design flaws early in the development process, thereby reducing material waste and labor costs. This shift towards virtual solutions is particularly evident in sectors such as automotive and aerospace, where the cost of physical prototypes can be exorbitant. The anticipated growth to 4015.5 USD Million by 2035 underscores the financial benefits that virtual engineering brings to organizations seeking to optimize their operations.