Growing Demand for Customization

In the US Virtual Engineering Market, there is a growing demand for customization in engineering solutions. As industries such as automotive, aerospace, and consumer electronics evolve, companies are seeking tailored engineering services that meet specific requirements. This trend is particularly evident in sectors where consumer preferences are rapidly changing, necessitating agile engineering processes. Market data indicates that the customization segment is expected to account for a substantial share of the overall market, driven by the need for unique product features and enhanced user experiences. Consequently, virtual engineering firms are adapting their offerings to cater to this demand, thereby positioning themselves for future growth.

Integration of Advanced Technologies

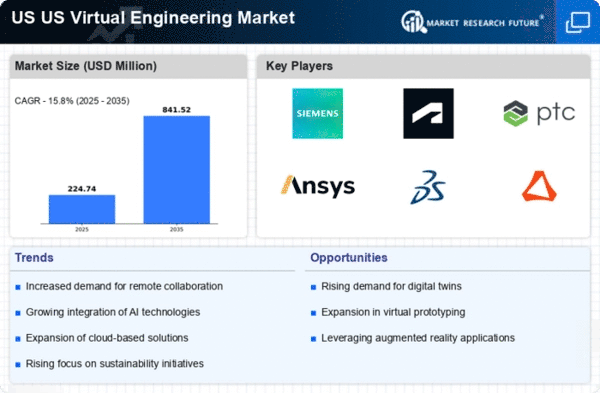

The US Virtual Engineering Market is experiencing a notable shift towards the integration of advanced technologies such as artificial intelligence, machine learning, and augmented reality. These technologies enhance design processes, enabling engineers to simulate and visualize complex systems more effectively. For instance, AI-driven tools can analyze vast datasets to optimize engineering designs, potentially reducing time-to-market for new products. According to recent data, the adoption of AI in engineering is projected to grow at a compound annual growth rate of over 25% in the coming years. This trend not only streamlines workflows but also fosters innovation, allowing companies to remain competitive in a rapidly evolving market.

Focus on Sustainability and Green Engineering

Sustainability has emerged as a critical driver in the US Virtual Engineering Market. Companies are increasingly prioritizing green engineering practices to minimize environmental impact and comply with stringent regulations. This shift is evident in the adoption of sustainable materials and energy-efficient designs, which not only reduce carbon footprints but also appeal to environmentally conscious consumers. Market analysis suggests that the demand for sustainable engineering solutions is likely to grow, as businesses recognize the long-term benefits of eco-friendly practices. By integrating sustainability into their core strategies, virtual engineering firms can enhance their competitive advantage and contribute to a more sustainable future.

Regulatory Support and Government Initiatives

The US Virtual Engineering Market benefits from various regulatory support and government initiatives aimed at promoting technological advancements. Federal and state governments are increasingly investing in infrastructure projects that require sophisticated engineering solutions. For example, the Infrastructure Investment and Jobs Act allocates significant funding for modernizing transportation and energy systems, which in turn drives demand for virtual engineering services. This regulatory environment encourages collaboration between public and private sectors, fostering innovation and growth within the industry. As a result, companies are likely to leverage these initiatives to enhance their capabilities and expand their market presence.

Enhanced Collaboration Tools and Remote Capabilities

The US Virtual Engineering Market is witnessing a surge in enhanced collaboration tools and remote capabilities. As organizations increasingly adopt remote work models, the need for effective virtual collaboration has become paramount. Advanced software solutions enable teams to work together seamlessly, regardless of geographical location, thereby improving productivity and innovation. Market data indicates that the demand for collaborative engineering platforms is on the rise, with projections suggesting a growth rate of over 20% in the next few years. This trend not only facilitates real-time communication but also allows for the integration of diverse expertise, ultimately leading to more robust engineering solutions.