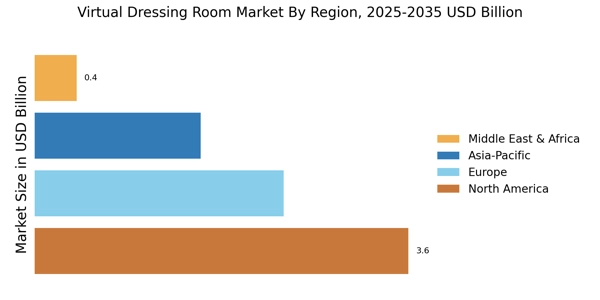

By Region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. North America Virtual Dressing Room Market accounted for USD 2.376 billion in 2021 and is expected to exhibit a significant CAGR growth during the study period. The North America market share is driven by increasing adoption of Augmented Reality (AR), Virtual Reality (VR), and Artificial Intelligence (AI) technology in the retail sector and e-commerce stores. These technologies help customers to try on different products with virtual try-ons and fitting rooms to increase customer engagement and conversion rate.

Further, many well-established retailers in the region are engaged in the acquisition of small scale e-commerce platforms to increase their customer base as well as brand building.

Further, the major countries studied in the market report are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: Virtual Dressing Room Market, MARKET SHARE BY REGION 2021 (%)

Europe Virtual Dressing Room Market accounts for the second-largest market share. The region has played a significant role in introducing new trends, styles, and designs, which are then followed by other fashion enthusiasts globally. The presence of an extensive retailer base is encouraging the setting up of multiple startups in this region. Furthermore, the rising competitiveness among retailers is offering growth prospects to the regional market, as retailers are increasingly adopting innovative digital technologies to increase footfall as well as engagement levels.

Further, the Germany Virtual Dressing Room Market held the largest market share, and the UK Virtual Dressing Room Market was the fastest growing market in the European region.

The Asia-Pacific Virtual Dressing Room Market is expected to grow at the fastest CAGR from 2022 to 2030. The soaring demand for advanced solutions that can help customers make prompt buying decisions is likely to contribute to the regional market growth. Top e-commerce portals in these countries are adopting fitting room solutions as the region also features an end-user base with the highest number of smartphone users. The benefits of virtual dressing rooms in offering a collaborative online buying experience are expected to trigger the demand in the Asia Pacific region over the forecast period.

Moreover, China Virtual Dressing Room Market held the largest market share, and the India Virtual Dressing Room Market was the fastest growing market in the Asia-Pacific region.