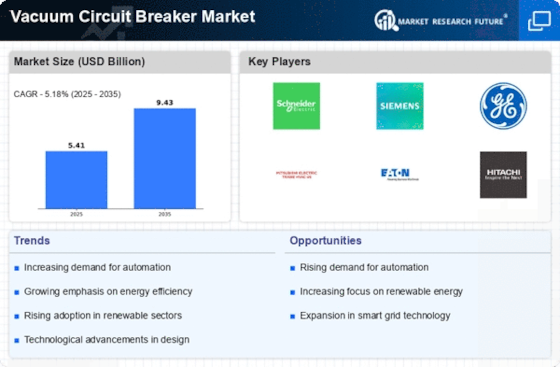

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources, such as solar and wind, is driving the Vacuum Circuit Breaker Market. As more countries invest in sustainable energy infrastructure, the need for reliable and efficient circuit protection becomes paramount. Vacuum circuit breakers are particularly suited for renewable energy applications due to their compact size and ability to operate in harsh environments. The market for renewable energy is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 8% in the coming years. This growth directly correlates with the rising demand for vacuum circuit breakers, as they play a crucial role in ensuring the safety and reliability of renewable energy systems.

Government Regulations and Standards

Stringent government regulations and standards regarding electrical safety and efficiency are shaping the Vacuum Circuit Breaker Market. Regulatory bodies are increasingly mandating the use of advanced circuit protection devices to enhance safety in electrical installations. Vacuum circuit breakers, known for their reliability and low environmental impact, are often preferred to meet these regulatory requirements. The implementation of such regulations is likely to drive market growth, as manufacturers and utility companies seek to comply with safety standards. Recent reports indicate that compliance with these regulations could lead to a market expansion of around 6% over the next few years.

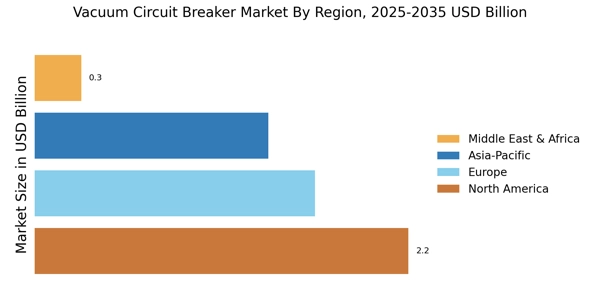

Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development are pivotal factors influencing the Vacuum Circuit Breaker Market. As urban areas expand, the demand for reliable electrical distribution systems increases. Vacuum circuit breakers are favored in urban settings due to their space-saving design and minimal maintenance requirements. The construction of new residential and commercial buildings necessitates the installation of advanced electrical systems, which often include vacuum circuit breakers. According to recent data, the construction sector is expected to witness a growth rate of approximately 5% annually, further propelling the demand for vacuum circuit breakers in urban infrastructure projects.

Technological Innovations in Circuit Protection

Technological innovations in circuit protection are significantly impacting the Vacuum Circuit Breaker Market. Advancements in materials and design have led to the development of more efficient and reliable vacuum circuit breakers. These innovations enhance performance, reduce maintenance costs, and extend the lifespan of circuit breakers. The integration of smart technologies, such as remote monitoring and control, is also becoming more prevalent, allowing for improved operational efficiency. As technology continues to evolve, the market for vacuum circuit breakers is expected to grow, with projections indicating a potential increase in market size by 7% in the next five years.

Increased Investment in Electrical Infrastructure

The surge in investment in electrical infrastructure is a key driver of the Vacuum Circuit Breaker Market. Governments and private entities are allocating substantial funds to upgrade aging electrical grids and expand distribution networks. This investment is crucial for enhancing the reliability and efficiency of power delivery systems. Vacuum circuit breakers are integral to these upgrades, providing essential protection and control in electrical networks. Recent data suggests that investment in electrical infrastructure could reach unprecedented levels, with an expected growth rate of 5% annually, thereby boosting the demand for vacuum circuit breakers in various applications.