Vacuum Circuit Breaker Size

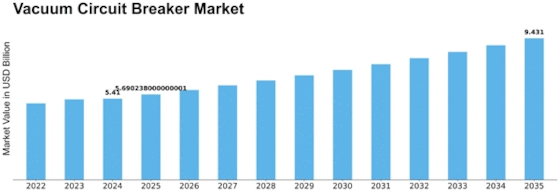

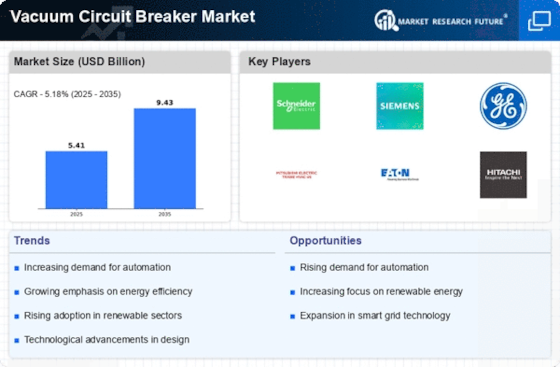

Vacuum Circuit Breaker Market Growth Projections and Opportunities

Vacuum circuit breaker is an active field in the electrical equipment sector, which experiences continuous growth and development. In this niche market, there are a combination of innovative technologies, evolving regulations and ever increasing requirement for reliable power transmission systems. Technological innovations play a critical role in driving Vacuum circuit breaker dynamics on the market. As such industries and infrastructure continue to evolve, more sophisticated as well as efficient circuit breaking solutions are necessary. Manufacturers within Vacuum circuit breaker market are continually investing in research and development so as to introduce advanced technologies capable of enhancing their products’ performance, reliability and safety. The integration of digital components, intelligent control systems and advanced materials has become a common trend that allows Vacuum circuit breaker to operate more efficiently and adapt to various applications. Regulatory changes also have a significant impact on Vacuum circuit breaker ’s market dynamics. Governments globally have been emphasizing the need for sustainable technologies in different sectors including power distribution. Consequently, strict environmental laws have been enacted encouraging the use of vacuum technology in circuit breakers. This is because they are environmentally friendly compared to traditional ones with no greenhouse gas emissions during operation. Therefore, meeting these regulations has become one of the main drivers prompting companies operating within this industry to invest in manufacturing and promoting Vacuum circuit breaker. The demand for Vacuum circuit breakers is driven by the increasing need for reliable electricity distribution systems. Fast urbanization process coupled with industrialization together with the rise of renewable energy sources has led to increased demand for strong electrical infrastructure. Due to its ability of ensuring efficiency as well as interruption free power delivery enables Vacuum circuit breaker play an integral part towards maintaining grid stability today. Additionally, awareness about economic losses associated with power interruptions has pushed many industries into investing highly priced circuit breakers further fueling growth within Vacuum circuit breaker space.

Leave a Comment