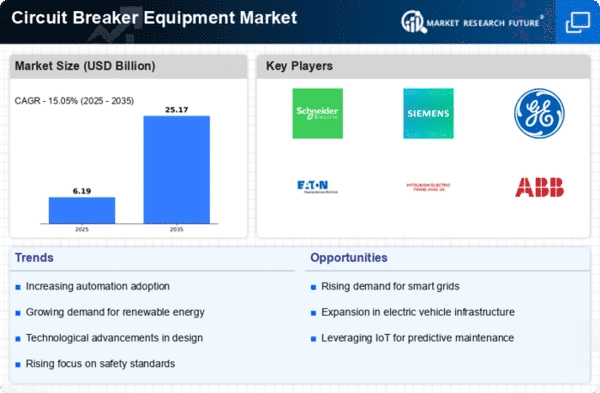

Market Growth Projections

The Circuit Breaker for Equipment Market is on a trajectory of robust growth, with projections indicating a market size of 25.75 USD Billion in 2024 and an anticipated increase to 45.32 USD Billion by 2035. This growth is underpinned by a compound annual growth rate of 5.27% from 2025 to 2035, reflecting the industry's response to evolving technological demands and regulatory pressures. The market's expansion is indicative of the critical role circuit breakers play in modern electrical systems, ensuring safety, efficiency, and reliability.

Growing Infrastructure Development

Infrastructure development is a significant driver of the Global Circuit Breaker for Equipment Market. With urbanization and industrialization on the rise, there is a heightened demand for reliable electrical systems in new constructions. Governments worldwide are investing heavily in infrastructure projects, which necessitate the installation of robust circuit breakers to ensure safety and efficiency. This trend is expected to contribute to the market's growth, with projections indicating a market size of 45.32 USD Billion by 2035, underscoring the critical role of circuit breakers in supporting infrastructure expansion.

Increasing Demand for Energy Efficiency

The Circuit Breaker for Equipment Industry experiences a rising demand for energy-efficient solutions. As industries strive to reduce operational costs and minimize environmental impact, circuit breakers that enhance energy efficiency are becoming essential. For instance, the integration of smart technologies in circuit breakers allows for real-time monitoring and optimization of energy consumption. This trend is reflected in the market's projected growth, with a valuation of 25.75 USD Billion in 2024, indicating a strong shift towards sustainable practices across various sectors.

Regulatory Compliance and Safety Standards

The Circuit Breaker for Equipment Market is influenced by stringent regulatory compliance and safety standards. Governments and regulatory bodies are increasingly mandating the use of advanced circuit breakers to enhance electrical safety in residential, commercial, and industrial applications. Compliance with these regulations not only mitigates risks but also drives the adoption of innovative circuit breaker solutions. As industries adapt to these requirements, the market is poised for growth, reflecting the importance of safety in electrical installations and operations.

Rising Adoption of Renewable Energy Sources

The shift towards renewable energy sources significantly impacts the Circuit Breaker for Equipment Market. As solar and wind energy installations proliferate, there is a growing need for circuit breakers that can handle the unique challenges posed by these energy sources. Circuit breakers designed for renewable applications ensure the safe integration of alternative energy into existing grids. This trend is likely to propel market growth, as the industry adapts to the increasing reliance on sustainable energy solutions.

Technological Advancements in Circuit Breakers

Technological innovations play a pivotal role in shaping the Circuit Breaker for Equipment Market. The introduction of digital circuit breakers, which offer enhanced functionalities such as remote monitoring and automated fault detection, is transforming traditional practices. These advancements not only improve safety and reliability but also cater to the evolving needs of modern electrical systems. As a result, the market is expected to witness a compound annual growth rate of 5.27% from 2025 to 2035, reflecting the increasing adoption of advanced circuit breaker technologies.