Top Industry Leaders in the Vacuum Circuit Breaker Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

Competitive Landscape of Vacuum Circuit Breaker Market: Strategies, Trends, and Outlook

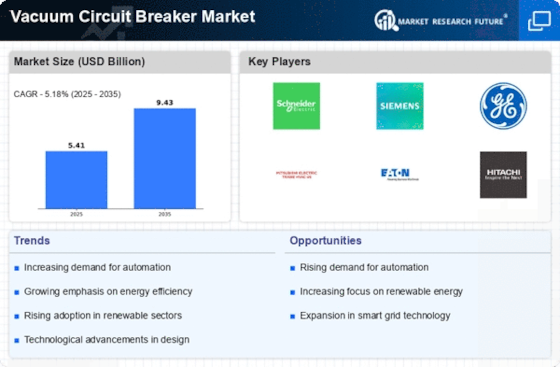

The vacuum circuit breaker (VCB) market, valued at over $900 million in 2022, is projected to experience steady growth at a CAGR of 5.8% reaching $1.7 billion by 2032. This growth is driven by factors like rising demand from utilities and industries, focus on renewable energy integration, and increasing electrification in developing countries.

The competitive landscape of this market is dynamic, with established players like ABB, Siemens, Schneider Electric, and Eaton vying for dominance alongside regional players like TGOOD Electric and Chint Electric.

Key Player Strategies:

Technology Leadership: Leading players are heavily investing in R&D to develop more compact, efficient, and cost-effective VCBs. They are focusing on advancements in vacuum interrupter technology, materials, and insulation systems. For example, Schneider Electric's Green Circuit Breaker portfolio features VCBs with reduced environmental impact.

Market Diversification: Players are expanding their presence beyond traditional high-voltage segments by targeting medium-voltage applications in sectors like railways, data centers, and renewable energy installations. Toshiba, for instance, is focusing on VCBs for railway infrastructure projects.

Strategic Acquisitions and Partnerships: Mergers and acquisitions are playing a significant role in market consolidation. Eaton's acquisition of Cutler-Hammer strengthened its VCB portfolio in North America. Additionally, partnerships with local players in emerging markets are helping companies gain market access and expertise.

Focus on Service and Maintenance: Leading players are offering comprehensive service and maintenance packages to cater to the growing demand for after-sales support. This helps build customer loyalty and lock them into long-term contracts.

Factors for Market Share Analysis:

Product Portfolio Breadth: Players with a wider range of VCBs catering to different voltage levels, applications, and technical specifications tend to hold a larger market share.

Brand Reputation and Quality: Established brands with a proven track record of reliability and quality enjoy greater customer trust and market share compared to newer entrants.

Geographical Presence: Companies with a strong global presence and established distribution networks have an advantage over competitors focused on specific regions.

Price Competitiveness: While cost is a significant factor, offering value for money through features, performance, and service differentiates players in a competitive market.

New and Emerging Trends:

Smart VCBs: Integration of sensors and communication technologies into VCBs is enabling real-time monitoring, data analytics, and predictive maintenance, enhancing operational efficiency and reliability.

Miniaturization and Compact Designs: Growing space constraints, particularly in urban environments, are driving demand for smaller and lighter VCBs.

Focus on Sustainability: Environmental regulations and corporate sustainability goals are leading to the development of eco-friendly VCBs with reduced environmental impact and increased recyclability.

Overall Competitive Scenario:

The VCB market is expected to remain fiercely competitive in the coming years. While established players will leverage their brand reputation and technological expertise, regional players and new entrants focusing on niche segments and disruptive technologies can pose a challenge. The key to success will lie in continuous innovation, strategic partnerships, and adapting to evolving market dynamics, particularly the growing emphasis on digitalization and sustainability.

Schneider Electric SE (Dec 2023): Announced partnership with Nissin Electric to develop and manufacture medium-voltage VCBs for Asia-Pacific markets. (Source: Schneider Electric press release)

ABB Ltd. (Oct 2023): Launched EcoFit Plus VCB line with improved sustainability features and reduced environmental impact. (Source: ABB press release)

Mitsubishi Electric Corporation (Aug 2023): Successfully tested a prototype 800 kV VCB, expanding its high-voltage product portfolio. (Source: Mitsubishi Electric press release)

Alstom SA (Sep 2023): Secured a contract to supply VCBs for a major HVDC project in Europe. (Source: Alstom press release)

Siemens AG (Nov 2023): Unveiled a new generation of VCBs with advanced digital functionalities for predictive maintenance. (Source: Siemens press release)

Toshiba (Oct 2023): Received an order for VCBs for a wind farm project in Japan. (Source: Toshiba press release)

Top listed global companies in the industry are:

Schneider Electric SE

ABB Ltd.

Mitsubishi Electric Corporation

Alstom SA

Siemens AG

Toshiba

Larsen & Turbo

Hyundai Heavy Industries

Hitachi

Fuji Electric

Nissin Electric

Xian XD

Hyosung

Bharat Heavy Electric Ltd.

Eaton

Meidensha