Growing Health Consciousness

The increasing awareness of health and wellness among consumers is driving the protein ingredients market. As individuals prioritize nutrition, they seek products rich in protein to support their dietary needs. This trend is particularly evident in the rise of high-protein snacks and meal replacements, which have gained traction in the market. According to recent data, the demand for protein-rich foods has surged, with a notable increase of 20% in sales over the past year. This shift towards healthier eating habits is likely to continue, as consumers become more educated about the benefits of protein in maintaining muscle mass and overall health. Consequently, the protein ingredients market is expected to expand as manufacturers innovate to meet this growing demand for health-oriented products.

Expansion of Sports Nutrition Sector

The protein ingredients market is significantly influenced by the expansion of the sports nutrition sector. As more individuals engage in fitness and athletic activities, the demand for protein supplements and fortified foods has surged. This sector has seen a remarkable growth rate of 15% annually, driven by the increasing participation in sports and fitness programs. Athletes and fitness enthusiasts are actively seeking high-quality protein sources to enhance performance and recovery, which has led to a proliferation of protein powders, bars, and ready-to-drink products. The protein ingredients market is poised to capitalize on this trend, as manufacturers develop specialized products tailored to the needs of this growing consumer base, thereby further driving market growth.

Increased Demand for Functional Foods

The protein ingredients market is experiencing a notable shift towards functional foods, which are designed to provide health benefits beyond basic nutrition. Consumers are increasingly looking for products that enhance their well-being, such as those fortified with protein to support muscle recovery and weight management. This trend is reflected in the growing popularity of protein-enriched beverages and snacks, which have seen a rise in market share. Recent statistics indicate that functional foods account for approximately 30% of the total food market in the US, with protein ingredients playing a crucial role in this segment. As the demand for functional foods continues to rise, the protein ingredients market is likely to benefit from this trend, prompting manufacturers to innovate and diversify their product offerings.

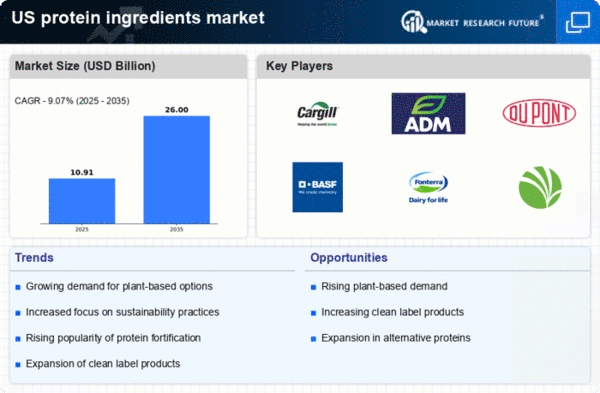

Rising Popularity of Clean Label Products

The protein ingredients market is witnessing a shift towards clean label products, which emphasize transparency and simplicity in ingredient sourcing. Consumers are increasingly scrutinizing food labels, seeking products that contain recognizable ingredients without artificial additives. This trend is particularly relevant in the protein ingredients market, where consumers prefer natural protein sources derived from plants or animals. Recent surveys indicate that over 60% of consumers are willing to pay a premium for clean label products, reflecting a significant market opportunity. As manufacturers respond to this demand by reformulating their offerings, the protein ingredients market is likely to see a rise in products that align with clean label principles, thereby enhancing consumer trust and loyalty.

Technological Advancements in Protein Extraction

Technological advancements in protein extraction and processing are playing a pivotal role in shaping the protein ingredients market. Innovations in extraction methods, such as enzymatic and membrane filtration techniques, are enhancing the efficiency and yield of protein production. These advancements not only improve the quality of protein ingredients but also reduce production costs, making them more accessible to manufacturers. Recent data suggests that the adoption of these technologies could lead to a 10% reduction in production costs over the next few years. As the protein ingredients market continues to evolve, these technological improvements are likely to drive growth by enabling the development of new and diverse protein products that cater to various consumer preferences.