Innovation in Food Technology

Innovation in food technology is driving advancements in the chickpea protein-ingredients market. The development of new processing techniques and formulations allows for the extraction of high-quality protein from chickpeas, enhancing their functionality in various applications. This innovation is crucial as food manufacturers seek to create products that meet consumer demands for taste, texture, and nutritional value. The chickpea protein-ingredients market is likely to benefit from these technological advancements, as they enable the creation of diverse food products, from snacks to meat alternatives. As the food industry continues to evolve, the role of chickpea protein ingredients is expected to expand, reflecting the ongoing innovation in food technology.

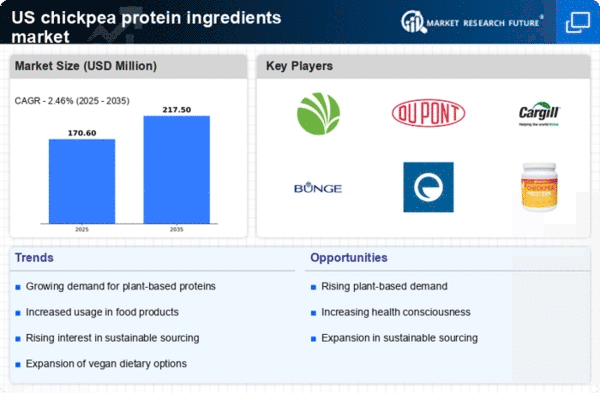

Growth of Vegan and Vegetarian Diets

The rise in the adoption of vegan and vegetarian diets is another critical driver influencing the chickpea protein ingredients market.. As more consumers opt for plant-based diets for ethical, environmental, or health reasons, the demand for chickpea protein ingredients is anticipated to increase. The number of individuals identifying as vegan in the US has reportedly increased by over 300% in recent years, highlighting a substantial shift in dietary preferences. This growing demographic is likely to seek out chickpea protein as a versatile ingredient in various food products, thereby enhancing the market's growth potential. The chickpea protein-ingredients market stands to benefit from this trend as manufacturers innovate to meet the needs of this expanding consumer base.

Health Consciousness Among Consumers

Increasing health consciousness among consumers is a pivotal driver for the chickpea protein ingredients market.. As individuals become more aware of the nutritional benefits associated with plant-based proteins, the demand for chickpea protein ingredients is likely to rise. Chickpeas are rich in protein, fiber, and essential nutrients, making them an attractive option for health-focused consumers. According to recent data, the plant-based protein market is projected to grow at a CAGR of approximately 8% through 2027, with chickpea protein playing a significant role in this expansion. This trend indicates a shift towards healthier eating habits, which is expected to bolster the chickpea protein-ingredients market significantly.

Rising Popularity of Functional Foods

The trend towards functional foods is significantly impacting the chickpea protein ingredients market.. Consumers are increasingly seeking foods that offer health benefits beyond basic nutrition, such as improved digestion, enhanced immunity, and weight management. Chickpea protein, known for its high protein content and nutritional profile, aligns well with this trend. The functional food market in the US is expected to reach approximately $275 billion by 2025, with plant-based proteins, including chickpea protein, playing a crucial role in this growth. This shift towards functional foods suggests that the chickpea protein-ingredients market could experience substantial demand as consumers prioritize health-enhancing products.

Increased Focus on Sustainable Sourcing

Increased focus on sustainable sourcing practices is a significant driver for the chickpea protein ingredients market.. As consumers become more environmentally conscious, they are seeking products that align with their values regarding sustainability. Chickpeas, being a drought-resistant crop, require less water and have a lower carbon footprint compared to animal-based protein sources. This sustainability aspect is appealing to consumers and manufacturers alike. The market for sustainable food products is projected to grow, with a notable increase in demand for plant-based proteins. This trend suggests that the chickpea protein-ingredients market could see enhanced growth as companies prioritize sustainable sourcing and production methods.