Rising Health Consciousness

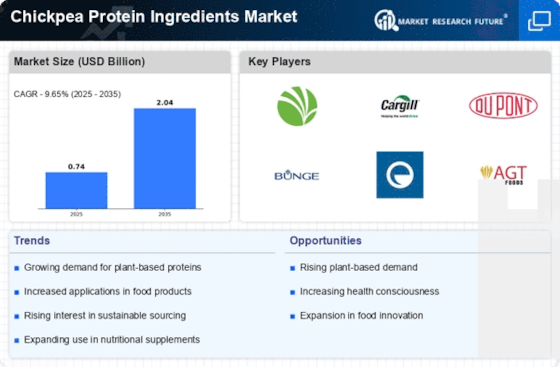

The increasing awareness of health and wellness among consumers appears to be a pivotal driver for the chickpea protein ingredients Market. As individuals seek healthier dietary options, the demand for plant-based proteins, particularly chickpea protein, has surged. This ingredient is recognized for its high protein content, essential amino acids, and various vitamins and minerals. Market data indicates that the plant-based protein segment is projected to grow at a compound annual growth rate of over 10% in the coming years. This trend suggests that consumers are gravitating towards chickpea protein as a nutritious alternative to animal-based proteins, thereby propelling the growth of the Chickpea Protein Ingredients Market.

Versatility in Food Applications

The versatility of chickpea protein ingredients in various food applications is a notable driver for the Chickpea Protein Ingredients Market. These ingredients can be utilized in a wide range of products, including snacks, beverages, and meat alternatives. Their ability to enhance texture, flavor, and nutritional profile makes them appealing to food manufacturers. Market analysis suggests that the demand for meat alternatives is on the rise, with projections indicating a significant increase in the market share of plant-based foods. This trend underscores the potential for chickpea protein to play a crucial role in the development of innovative food products, thereby fostering growth within the Chickpea Protein Ingredients Market.

Innovation in Product Development

Innovation in product development is a driving force behind the Chickpea Protein Ingredients Market. Manufacturers are increasingly investing in research and development to create new formulations and applications for chickpea protein. This includes the development of protein-enriched snacks, beverages, and functional foods that cater to the evolving preferences of health-conscious consumers. The market is witnessing a surge in innovative products that incorporate chickpea protein, which not only enhances nutritional value but also meets consumer demands for clean label and natural ingredients. This focus on innovation is likely to sustain the growth trajectory of the Chickpea Protein Ingredients Market, as companies strive to differentiate their offerings in a competitive landscape.

Growing Vegan and Vegetarian Population

The rise in the vegan and vegetarian population is a significant factor influencing the Chickpea Protein Ingredients Market. As more individuals adopt plant-based diets for ethical, health, or environmental reasons, the demand for plant-derived protein sources has escalated. Chickpea protein, being a complete protein, is particularly appealing to those seeking to meet their nutritional needs without animal products. Recent statistics indicate that the number of people identifying as vegan has increased by over 300% in the last decade. This demographic shift suggests a sustained demand for chickpea protein ingredients, as they provide a viable protein source for those adhering to plant-based diets.

Sustainability and Environmental Concerns

Sustainability has emerged as a critical consideration for consumers and manufacturers alike, influencing the Chickpea Protein Ingredients Market. The environmental impact of traditional livestock farming has led to a shift towards more sustainable protein sources. Chickpeas, being a legume, require less water and land compared to animal farming, making them an attractive option for eco-conscious consumers. Furthermore, the cultivation of chickpeas contributes to soil health through nitrogen fixation, which enhances agricultural sustainability. This growing emphasis on environmentally friendly practices is likely to drive the demand for chickpea protein ingredients, as consumers increasingly prefer products that align with their values regarding sustainability.