Rising E-commerce Demand

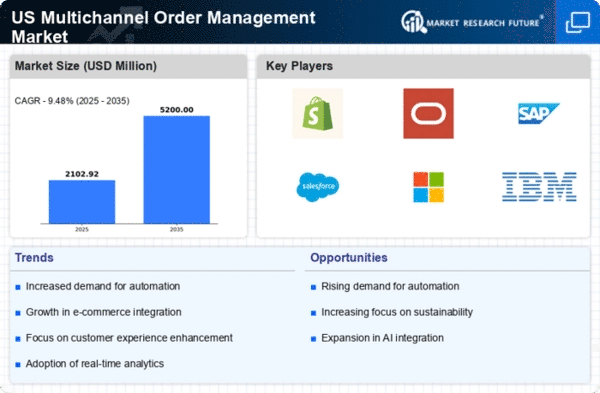

The multichannel order-management market is experiencing a surge in demand driven by the rapid growth of e-commerce in the US. As consumers increasingly prefer online shopping, businesses are compelled to adopt sophisticated order management systems to streamline operations. In 2025, e-commerce sales in the US are projected to reach approximately $1 trillion, indicating a robust market for multichannel solutions. This growth necessitates efficient inventory management and order fulfillment processes, which are critical for maintaining customer satisfaction. Companies that leverage advanced multichannel order-management systems can enhance their operational efficiency, reduce costs, and improve service delivery, thereby gaining a competitive edge in the marketplace.

Increased Focus on Data Analytics

The multichannel order-management market is witnessing an increased focus on data analytics as businesses seek to gain insights into consumer behavior and operational efficiency. By leveraging data analytics, companies can make informed decisions regarding inventory management, pricing strategies, and marketing efforts. In 2025, it is estimated that 70% of businesses will prioritize data-driven strategies, highlighting the importance of analytics in enhancing order management processes. This trend allows retailers to tailor their offerings to meet customer preferences, ultimately driving sales and improving customer retention rates.

Regulatory Compliance and Standards

Regulatory compliance and standards are becoming increasingly relevant in the multichannel order-management market. As businesses operate across various channels, they must adhere to a myriad of regulations concerning data protection, consumer rights, and product safety. In 2025, compliance-related costs are projected to account for approximately 5% of total operational expenses for retailers. Companies that proactively address these compliance issues can mitigate risks and enhance their reputation among consumers. This focus on regulatory adherence not only ensures legal compliance but also fosters trust and loyalty among customers, which is essential for long-term success in the multichannel order-management market.

Technological Advancements in Logistics

Technological advancements in logistics are significantly influencing the multichannel order-management market. Innovations such as artificial intelligence, machine learning, and automation are enhancing supply chain efficiency and accuracy. For instance, AI-driven analytics can predict demand trends, allowing businesses to optimize inventory levels and reduce stockouts. In 2025, the logistics technology market is expected to grow by over 15%, indicating a strong correlation with the multichannel order-management market. Companies that invest in these technologies can streamline their operations, reduce operational costs, and improve overall customer satisfaction, positioning themselves favorably in a competitive environment.

Consumer Expectations for Speed and Convenience

In the current landscape, consumer expectations for speed and convenience are reshaping the multichannel order-management market. Customers demand quick delivery times and seamless shopping experiences across various channels. Research indicates that 80% of consumers expect same-day or next-day delivery options, compelling retailers to optimize their order management processes. This trend drives the need for integrated systems that can handle orders from multiple sources efficiently. Businesses that can meet these expectations are likely to see increased customer loyalty and higher sales volumes, as satisfied customers are more inclined to return for future purchases.