Surge in Data Center Investments

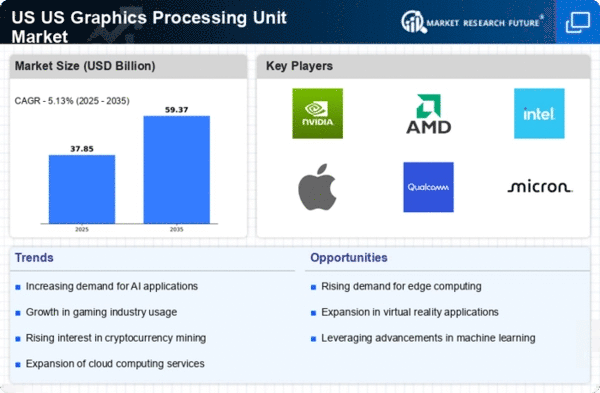

The US Graphics Processing Unit Market is experiencing a notable surge in investments directed towards data centers. As organizations increasingly rely on cloud computing and big data analytics, the demand for high-performance GPUs has escalated. In 2025, the data center segment accounted for approximately 30% of the total GPU market share in the United States. This trend is likely to continue, as companies seek to enhance their computational capabilities to support advanced applications such as artificial intelligence and machine learning. The growing need for efficient data processing and storage solutions is propelling the adoption of GPUs in data centers, thereby driving the overall market growth. Furthermore, government initiatives aimed at bolstering technological infrastructure may further stimulate investments in this sector, reinforcing the significance of GPUs in the US Graphics Processing Unit Market.

Increased Focus on AI-Driven Applications

The US Graphics Processing Unit Market is experiencing a heightened focus on AI-driven applications, which is significantly influencing GPU demand. As organizations across various sectors increasingly adopt artificial intelligence for data analysis, predictive modeling, and automation, the need for powerful GPUs has intensified. In 2025, AI applications accounted for approximately 25% of the total GPU market share in the United States. This trend is expected to persist as advancements in machine learning and deep learning technologies continue to evolve. The ability of GPUs to handle parallel processing tasks makes them indispensable for AI workloads, thereby driving their adoption in the market. Furthermore, government initiatives promoting AI research and development may further stimulate growth in the US Graphics Processing Unit Market, creating opportunities for innovation and expansion.

Expansion of E-Sports and Competitive Gaming

The US Graphics Processing Unit Market is significantly influenced by the rapid expansion of e-sports and competitive gaming. The e-sports sector has witnessed exponential growth, with revenues projected to reach over 1 billion USD by 2026. This burgeoning industry necessitates high-performance GPUs to deliver seamless gaming experiences, thereby driving demand within the market. As gaming enthusiasts increasingly seek superior graphics and performance, manufacturers are compelled to innovate and enhance their GPU offerings. The rise of streaming platforms and online gaming tournaments further amplifies this trend, as gamers require advanced hardware to compete effectively. Consequently, the e-sports phenomenon is likely to continue propelling the US Graphics Processing Unit Market, fostering a competitive landscape among GPU manufacturers.

Integration of GPUs in Automotive Technologies

The US Graphics Processing Unit Market is witnessing a transformative shift with the integration of GPUs in automotive technologies. As the automotive sector increasingly embraces advanced driver-assistance systems (ADAS) and autonomous vehicles, the demand for high-performance GPUs is on the rise. In 2025, the automotive segment represented approximately 15% of the total GPU market share in the United States. This trend is expected to grow as manufacturers seek to enhance vehicle safety and performance through sophisticated graphics processing capabilities. The incorporation of GPUs enables real-time data processing and visualization, which is crucial for the development of autonomous driving technologies. As regulatory frameworks evolve to support these advancements, the US Graphics Processing Unit Market is likely to benefit from increased investments in automotive GPU applications.

Rising Adoption of Virtual Reality and Augmented Reality

The US Graphics Processing Unit Market is significantly impacted by the rising adoption of virtual reality (VR) and augmented reality (AR) technologies. As industries such as gaming, education, and healthcare increasingly leverage VR and AR for immersive experiences, the demand for powerful GPUs is expected to surge. In 2025, the VR and AR segment accounted for nearly 20% of the total GPU market share in the United States. This trend is likely to continue as advancements in technology enhance the capabilities of VR and AR applications. The need for high-quality graphics and real-time rendering drives manufacturers to innovate and develop GPUs tailored for these applications. Consequently, the growing integration of VR and AR across various sectors is poised to propel the US Graphics Processing Unit Market, fostering a dynamic environment for GPU development.