Emergence of 5G Technology

The Real-Time Graphics and Video Rendering Solution Market is poised for growth with the emergence of 5G technology. This next-generation wireless technology offers significantly higher data transfer speeds and lower latency, which are critical for real-time rendering applications. The rollout of 5G networks is expected to enhance mobile gaming, streaming services, and augmented reality experiences, all of which rely heavily on real-time graphics. Analysts predict that the adoption of 5G will lead to a substantial increase in the number of connected devices, further driving the demand for efficient rendering solutions. As 5G technology becomes more widespread, the Real-Time Graphics and Video Rendering Solution Market is likely to experience a transformative impact, enabling new possibilities for developers and users alike.

Growing Investment in Gaming Industry

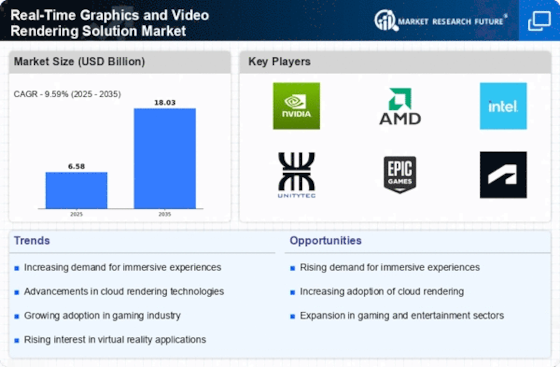

The Real-Time Graphics and Video Rendering Solution Market is significantly influenced by the growing investment in the gaming industry. With the gaming sector projected to surpass hundreds of billions in revenue, there is an increasing focus on enhancing the visual quality and performance of games. This trend drives the demand for advanced rendering solutions that can deliver real-time graphics with high fidelity. Game developers are continually seeking innovative technologies to create immersive experiences, which in turn fuels the growth of the rendering solutions market. As investments in gaming continue to rise, the Real-Time Graphics and Video Rendering Solution Market is likely to expand, offering new opportunities for both established companies and startups.

Rise of Virtual and Augmented Reality

The Real-Time Graphics and Video Rendering Solution Market is witnessing a notable rise in the adoption of virtual and augmented reality technologies. These immersive experiences require high-quality graphics and real-time rendering capabilities to create engaging environments for users. The market for virtual reality is expected to reach several billion dollars by the end of the decade, driven by applications in gaming, training, and education. As more industries recognize the value of immersive experiences, the demand for advanced rendering solutions that can deliver high-quality visuals in real-time is likely to increase. This trend not only enhances user engagement but also opens new avenues for innovation within the Real-Time Graphics and Video Rendering Solution Market.

Advancements in Graphics Processing Units

The Real-Time Graphics and Video Rendering Solution Market is experiencing a surge in demand due to rapid advancements in Graphics Processing Units (GPUs). These technological improvements enable higher frame rates and enhanced visual fidelity, which are crucial for applications in gaming, virtual reality, and professional visualization. The market for GPUs is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This growth is driven by the increasing need for real-time rendering capabilities across various sectors, including entertainment and design. As GPUs become more powerful and efficient, they facilitate the development of more sophisticated rendering solutions, thereby expanding the potential applications within the Real-Time Graphics and Video Rendering Solution Market.

Increased Demand for Real-Time Collaboration Tools

The Real-Time Graphics and Video Rendering Solution Market is benefiting from the increased demand for real-time collaboration tools. As businesses and organizations shift towards remote work and digital collaboration, the need for high-quality visual communication has become paramount. Rendering solutions that support real-time graphics are essential for applications such as video conferencing, online presentations, and collaborative design. The market for collaboration tools is projected to grow significantly, with estimates indicating a potential increase of over 15% annually. This growth is likely to drive further innovation in rendering technologies, as companies seek to enhance the quality and efficiency of their visual communication. Consequently, the Real-Time Graphics and Video Rendering Solution Market stands to gain from this evolving landscape.