Growth of Content Creation

The rise of content creation, particularly in video production and streaming, is significantly impacting the Graphics Add-in Board Market. As more individuals and businesses engage in content creation, the demand for high-performance graphics solutions is on the rise. In 2025, the content creation market is projected to exceed 40 billion USD, indicating a robust growth potential. Content creators require powerful graphics add-in boards to handle demanding tasks such as video editing, 3D rendering, and live streaming. This trend is prompting manufacturers to innovate and offer specialized products tailored to the needs of content creators, thereby driving growth within the Graphics Add-in Board Market. The increasing popularity of platforms like YouTube and Twitch further fuels this demand, as creators seek to deliver high-quality content to their audiences.

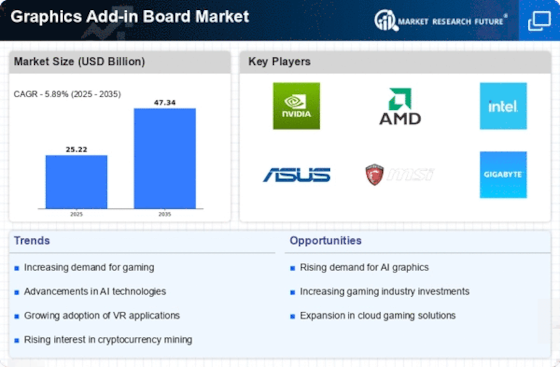

Increased Gaming Popularity

The Graphics Add-in Board Market is experiencing a surge in demand driven by the increasing popularity of gaming. As more individuals engage in gaming, the need for high-performance graphics solutions becomes paramount. In 2025, the gaming sector is projected to reach a valuation of approximately 200 billion USD, indicating a robust growth trajectory. This growth is likely to propel the demand for advanced graphics add-in boards, as gamers seek enhanced visual experiences and smoother gameplay. Furthermore, the rise of competitive gaming and eSports is contributing to this trend, as professional gamers require top-tier hardware to maintain a competitive edge. Consequently, manufacturers in the Graphics Add-in Board Market are focusing on innovation and performance enhancements to cater to this expanding consumer base.

Adoption of Artificial Intelligence

The integration of artificial intelligence (AI) into various applications is influencing the Graphics Add-in Board Market significantly. AI-driven technologies require substantial graphical processing capabilities, which in turn drives the demand for advanced graphics add-in boards. In 2025, the AI market is expected to surpass 500 billion USD, suggesting a strong correlation between AI advancements and the need for high-performance graphics solutions. As industries such as healthcare, automotive, and finance increasingly adopt AI, the requirement for powerful graphics processing units (GPUs) becomes evident. This trend indicates that the Graphics Add-in Board Market must adapt to meet the evolving needs of AI applications, potentially leading to innovative product offerings that enhance computational efficiency and graphical fidelity.

Rise of Virtual Reality Applications

The emergence of virtual reality (VR) applications is reshaping the landscape of the Graphics Add-in Board Market. As VR technology becomes more accessible, the demand for high-quality graphics rendering is escalating. In 2025, the VR market is anticipated to reach a valuation of around 50 billion USD, underscoring the growing interest in immersive experiences. This trend compels manufacturers to develop graphics add-in boards that can support the demanding requirements of VR applications, including high frame rates and low latency. Consequently, the Graphics Add-in Board Market is likely to witness increased investment in research and development to create products that cater specifically to the needs of VR developers and users, thereby enhancing the overall user experience.

Emergence of High-Resolution Displays

The proliferation of high-resolution displays is a key driver for the Graphics Add-in Board Market. As consumers increasingly adopt 4K and 8K displays, the need for powerful graphics processing capabilities becomes essential. In 2025, the market for high-resolution displays is expected to grow significantly, with millions of units sold worldwide. This trend necessitates the development of advanced graphics add-in boards that can support the rendering of high-resolution content without compromising performance. Manufacturers in the Graphics Add-in Board Market are likely to focus on enhancing their product offerings to meet the demands of consumers seeking superior visual experiences. The shift towards high-resolution gaming and media consumption further emphasizes the importance of robust graphics solutions in this evolving market.