Growing Public Awareness and Acceptance

Public awareness and acceptance of genetic engineering technologies are evolving within the US Genetic Engineering Market. Educational initiatives and outreach programs have contributed to a better understanding of the benefits and safety of genetically modified organisms (GMOs). Surveys indicate that consumer acceptance of GM foods has increased, with approximately 60% of Americans now supporting their use. This shift in public perception is crucial for the market's growth, as it encourages food manufacturers to incorporate genetically engineered ingredients into their products. As consumers become more informed, the demand for GMOs is likely to rise, further driving the market forward.

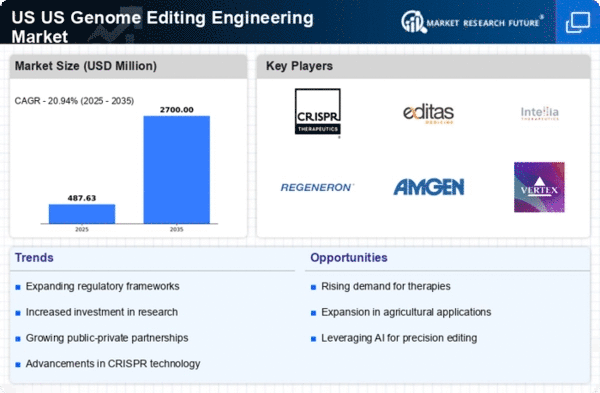

Innovations in Gene Editing Technologies

The US Genetic Engineering Market is witnessing rapid advancements in gene editing technologies, particularly CRISPR-Cas9. These innovations are revolutionizing the way genetic modifications are made, allowing for more precise and efficient alterations. The market for gene editing is projected to reach USD 5 billion by 2027, reflecting a compound annual growth rate of over 20%. This surge is attributed to the technology's potential applications in agriculture, medicine, and industrial biotechnology. As researchers and companies continue to explore the capabilities of gene editing, the US market is likely to see an influx of new products and solutions that address various challenges, from crop diseases to genetic disorders.

Regulatory Support for Genetic Engineering

The regulatory landscape for genetic engineering in the US is becoming increasingly supportive, which is a significant driver for the US Genetic Engineering Market. The USDA and FDA have established frameworks that facilitate the approval process for genetically engineered products, streamlining the path to market for new innovations. In 2025, the USDA announced a new initiative aimed at expediting the review of gene-edited crops, which could potentially reduce the time and cost associated with bringing these products to market. This regulatory support not only encourages investment in genetic engineering but also enhances the competitiveness of US products in the global market.

Rising Demand for Genetically Modified Crops

The US Genetic Engineering Market is experiencing a notable increase in demand for genetically modified (GM) crops. This trend is driven by the need for enhanced agricultural productivity and sustainability. According to the USDA, the adoption of GM crops has led to a significant reduction in pesticide use, which is appealing to environmentally conscious consumers. In 2025, approximately 94% of soybean and 92% of cotton planted in the US were genetically engineered varieties. This growing acceptance of GM crops among farmers and consumers alike is likely to propel the market forward, as stakeholders seek to address food security challenges and improve crop resilience against climate change.

Increased Investment in Biotechnology Research

Investment in biotechnology research is a critical driver of the US Genetic Engineering Market. In recent years, federal funding for genetic research has increased, with the National Institutes of Health (NIH) allocating over USD 40 billion annually for biomedical research. This financial support fosters innovation and encourages collaboration between academic institutions and private companies. Furthermore, venture capital investments in biotech startups have surged, with over USD 10 billion invested in 2025 alone. This influx of capital is likely to accelerate the development of new genetic engineering applications, enhancing the overall growth of the market and positioning the US as a leader in biotechnology.