Increased Funding and Investment

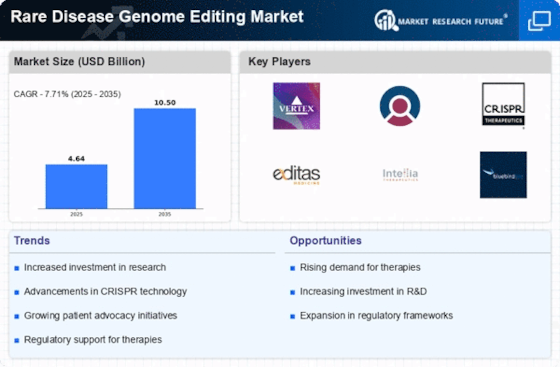

The Rare Disease Genome Editing Market is experiencing a surge in funding and investment from both public and private sectors. Governments and philanthropic organizations are increasingly recognizing the need for innovative solutions to combat rare diseases, leading to substantial financial support for research initiatives. In recent years, funding for rare disease research has seen a notable increase, with billions allocated to support the development of genome editing therapies. This influx of capital not only accelerates research efforts but also fosters collaboration between academic institutions and biotechnology companies. As a result, the Rare Disease Genome Editing Market is likely to benefit from enhanced research capabilities and the rapid translation of scientific discoveries into clinical applications, ultimately improving patient outcomes.

Regulatory Support and Frameworks

The evolving regulatory landscape is a significant driver for the Rare Disease Genome Editing Market. Regulatory agencies are increasingly recognizing the potential of genome editing technologies to address unmet medical needs in rare diseases. Recent initiatives have been introduced to streamline the approval process for innovative therapies, thereby encouraging investment and research in this field. For instance, regulatory frameworks are being adapted to facilitate the development of gene therapies and genome editing solutions, which are often subject to rigorous scrutiny. This supportive environment not only fosters innovation but also instills confidence among investors and researchers. As regulatory bodies continue to refine their approaches, the Rare Disease Genome Editing Market is expected to benefit from a more conducive environment for the development and commercialization of groundbreaking therapies.

Rising Prevalence of Rare Diseases

The increasing prevalence of rare diseases is a pivotal driver for the Rare Disease Genome Editing Market. It is estimated that approximately 7,000 rare diseases affect millions of individuals worldwide, with many remaining undiagnosed or misdiagnosed. This growing patient population necessitates innovative treatment solutions, propelling investments in genome editing technologies. As awareness of these conditions rises, healthcare providers and researchers are more inclined to explore genome editing as a viable therapeutic option. The demand for effective treatments is further underscored by the fact that nearly 80% of rare diseases have a genetic component, highlighting the potential of genome editing to address these underlying causes. Consequently, the Rare Disease Genome Editing Market is poised for substantial growth as stakeholders seek to develop targeted therapies for these underserved populations.

Growing Patient Advocacy and Awareness

Patient advocacy groups play a crucial role in driving the Rare Disease Genome Editing Market forward. These organizations raise awareness about rare diseases, mobilize resources, and advocate for research funding and policy changes. Their efforts have led to increased visibility of rare diseases, prompting both public and private sectors to prioritize research and development in this area. As patients and families become more informed about genome editing technologies, they are more likely to demand access to these innovative treatments. This growing advocacy is reflected in the establishment of numerous initiatives aimed at supporting research and facilitating clinical trials for rare diseases. Consequently, the Rare Disease Genome Editing Market is likely to see accelerated growth as patient voices become increasingly influential in shaping research agendas and funding priorities.

Advancements in Genome Editing Technologies

Technological advancements in genome editing tools, such as CRISPR-Cas9, are significantly influencing the Rare Disease Genome Editing Market. These innovations have enhanced the precision, efficiency, and accessibility of genome editing, making it a more attractive option for researchers and clinicians. The market has witnessed a surge in the development of novel editing techniques that allow for targeted modifications at the genetic level, which is crucial for addressing rare genetic disorders. According to recent estimates, the genome editing market is projected to reach USD 10 billion by 2026, driven by these technological breakthroughs. As researchers continue to refine these tools, the potential applications in the Rare Disease Genome Editing Market expand, offering hope for effective treatments for previously untreatable conditions.