Growing Demand for Genetic Testing

The Digital Genome Market is witnessing a notable increase in the demand for genetic testing services. As awareness of genetic disorders and hereditary diseases rises, more individuals are seeking genetic testing to understand their predispositions. This trend is further fueled by the increasing availability of direct-to-consumer genetic testing kits, which empower individuals to take charge of their health. Market data indicates that the genetic testing segment is expected to account for a substantial share of the Digital Genome Market, with revenues projected to reach several billion dollars by 2026. Additionally, the integration of genetic testing into routine healthcare practices is likely to enhance preventive care strategies, thereby driving further growth in the market.

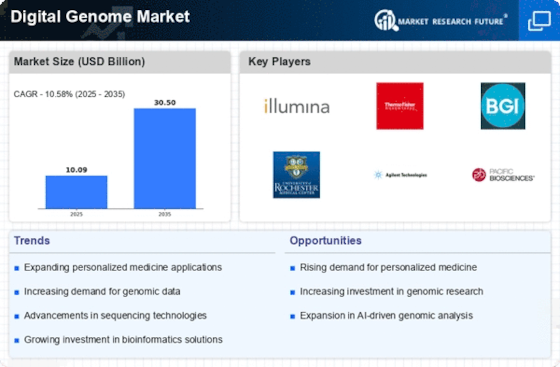

Advancements in Genomic Technologies

The Digital Genome Market is experiencing a surge due to rapid advancements in genomic technologies. Innovations such as next-generation sequencing (NGS) and CRISPR gene editing are revolutionizing the way genetic information is analyzed and utilized. These technologies enable researchers and healthcare providers to obtain detailed genomic data more efficiently and cost-effectively. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. This growth is driven by the increasing demand for precision medicine and targeted therapies, which rely heavily on genomic data. Furthermore, the integration of these technologies into clinical settings enhances the ability to diagnose and treat genetic disorders, thereby expanding the scope of the Digital Genome Market.

Expansion of Bioinformatics Solutions

The Digital Genome Market is poised for growth due to the expansion of bioinformatics solutions that facilitate the analysis and interpretation of genomic data. As the volume of genomic data generated continues to increase, there is a pressing need for sophisticated bioinformatics tools that can manage, analyze, and visualize this information. The development of cloud-based bioinformatics platforms is particularly noteworthy, as they offer scalable solutions for researchers and healthcare providers. Market data indicates that the bioinformatics segment is expected to experience a robust growth trajectory, contributing significantly to the overall Digital Genome Market. This expansion is likely to enhance the efficiency of genomic research and clinical applications, ultimately leading to improved healthcare outcomes.

Rising Prevalence of Chronic Diseases

The Digital Genome Market is significantly influenced by the rising prevalence of chronic diseases, which necessitate advanced diagnostic and therapeutic solutions. Conditions such as cancer, diabetes, and cardiovascular diseases are increasingly being linked to genetic factors, prompting a greater focus on genomic research. As healthcare providers seek to develop more effective treatment strategies, the demand for genomic data and personalized medicine is expected to rise. Market analyses suggest that the increasing burden of chronic diseases could drive the Digital Genome Market to new heights, with a projected market value reaching tens of billions of dollars by the end of the decade. This trend underscores the importance of integrating genomic insights into clinical practice to enhance patient outcomes.

Regulatory Support and Funding Initiatives

The Digital Genome Market benefits from increasing regulatory support and funding initiatives aimed at promoting genomic research and innovation. Governments and regulatory bodies are recognizing the potential of genomics in transforming healthcare and are implementing policies to facilitate research and development. For instance, funding programs for genomic research projects are being established, which provide financial resources to academic institutions and biotech companies. This support is crucial for advancing the development of new genomic technologies and applications. Moreover, favorable regulatory frameworks are being developed to streamline the approval processes for genomic-based therapies and diagnostics. Such initiatives are expected to bolster the growth of the Digital Genome Market, as they create a conducive environment for innovation and collaboration.