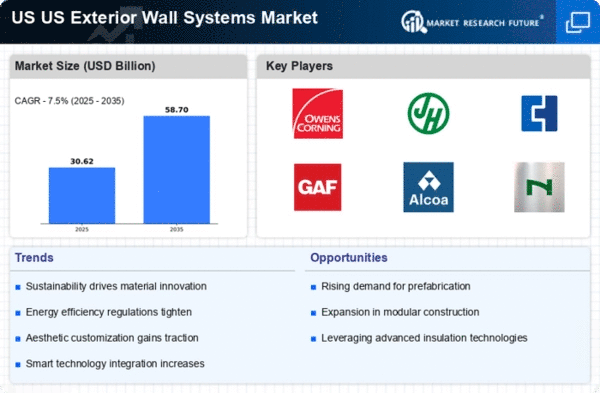

Urbanization Trends

Urbanization is a significant driver of the US Exterior Wall System Market. As more people migrate to urban areas, the demand for residential and commercial buildings increases. According to the US Census Bureau, urban areas are projected to house approximately 90% of the population by 2050. This surge in urban development necessitates the use of advanced exterior wall systems that can withstand various environmental challenges. Additionally, urbanization often leads to stricter building codes, which further propels the demand for high-performance wall systems that offer durability and energy efficiency.

Sustainability Initiatives

The US Exterior Wall System Market is increasingly influenced by sustainability initiatives. As environmental concerns gain prominence, building codes and regulations are evolving to prioritize energy efficiency and sustainable materials. The US Green Building Council's LEED certification program encourages the adoption of eco-friendly exterior wall systems, which can reduce energy consumption by up to 30%. This shift towards sustainability not only meets regulatory requirements but also appeals to environmentally conscious consumers. Consequently, manufacturers are innovating to provide products that align with these sustainability goals, thereby driving growth in the market.

Technological Advancements

Technological advancements play a crucial role in shaping the US Exterior Wall System Market. The integration of smart technologies into building materials enhances energy efficiency and user comfort. For instance, the use of insulated panels and advanced cladding systems can significantly reduce heating and cooling costs. The market is witnessing a rise in demand for products that incorporate smart sensors and automation, which can optimize energy usage in real-time. As these technologies become more accessible, they are likely to drive innovation and growth within the exterior wall system sector.

Aesthetic Trends and Customization

Aesthetic trends and customization options are increasingly shaping the US Exterior Wall System Market. As consumers become more discerning about the appearance of their buildings, there is a growing demand for exterior wall systems that offer both functionality and visual appeal. Manufacturers are responding by providing a variety of materials, colors, and finishes that allow for greater personalization. This trend is particularly evident in urban areas, where unique architectural designs are sought after. The ability to customize exterior wall systems not only enhances the aesthetic value of buildings but also contributes to the overall market expansion.

Government Regulations and Incentives

Government regulations and incentives are pivotal in influencing the US Exterior Wall System Market. Federal and state policies aimed at reducing carbon emissions and promoting energy efficiency are encouraging builders to adopt advanced exterior wall systems. Programs such as the Energy Star initiative provide financial incentives for using energy-efficient materials, which can lead to substantial cost savings over time. These regulations not only foster a competitive market but also ensure that manufacturers focus on developing products that comply with stringent energy standards, thereby driving market growth.