Top Industry Leaders in the US Exterior Wall Systems Market

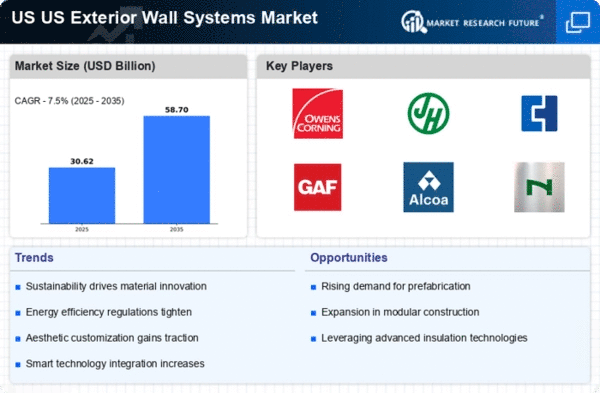

The US exterior wall systems market is a dynamic and diverse sector projected to reach USD 57.32 billion by 2032, growing at a CAGR of 8.20% between 2023 and 2032. From vinyl siding to advanced curtain walls, these systems define a building's aesthetics, weather resistance, and energy efficiency. Understanding the competitive landscape is crucial for manufacturers, distributors, and construction professionals in navigating this evolving market.

Key Segments and Driving Forces:

-

Material: Vinyl, brick, fiber cement, and metal dominate the market, but sustainable options like wood and composites are gaining traction. -

Type: Non-ventilated facades remain prevalent, but curtain walls and ventilated facades witness increasing demand in commercial and high-rise projects. -

End-use: Residential construction holds a larger share, but the non-residential segment, driven by infrastructure investments and renovation projects, is growing rapidly.

Market Share: Strategies and Players:

Market share in the US exterior wall systems market is distributed among established players and emerging regional companies. Key strategies shaping the competitive landscape include:

-

Product Innovation: Companies like Owens Corning and James Hardie are investing in research and development, introducing low-maintenance, energy-efficient, and eco-friendly materials. -

Vertical Integration: Leading manufacturers like CertainTeed and Ply Gem are expanding their presence across the supply chain, gaining control over production and distribution. -

Strategic Partnerships: Collaborations with architects, construction firms, and distributors create wider market reach and cater to specific project needs. -

Sustainability Focus: Environmental regulations and consumer demand are driving the adoption of recycled materials, low-VOC finishes, and energy-saving systems.

Key Companies in the exterior wall systems market include

- PPG Industries, Inc. (U.S.)

- Owens Corning (U.S.)

- DuPont (U.S.)

- Dow (U.S.)

- AGC Inc. (Japan)

- Sika AG (Switzerland)

- 3A Composite Holding AG (Switzerland)

- Etex Group (Belgium)

- Evonik Industries AG (Germany)

- LafargeHolcim (Switzerland)

Recent Development

-

August 2023: Owens Corning announced the launch of its new OPTIMAX® High-Performance Insulating Sheathing, designed to improve energy efficiency in residential construction. -

September 2023: The International Code Council (ICC) approved the International Building Code (IBC) 2024, which includes new requirements for fire-resistant exterior wall systems. -

October 2023: The National Association of Home Builders (NAHB) reported a slight decline in single-family home construction, potentially impacting the residential segment of the market. -

November 2023: PPG Industries announced a strategic partnership with a leading European manufacturer of ventilated facade systems to expand its product portfolio in the US market.