Market Trends

Key Emerging Trends in the US Exterior Wall Systems Market

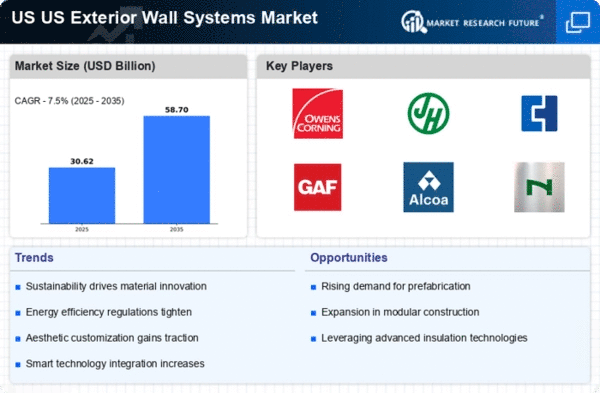

The US Exterior Wall Systems Market is currently witnessing significant trends that reflect the changing dynamics within the construction and architectural sectors. One prominent trend is the increasing focus on energy efficiency and sustainability in building design. As environmental consciousness grows, there is a rising demand for exterior wall systems that contribute to energy conservation and eco-friendly construction practices. This trend has led to the adoption of innovative materials and technologies, such as insulated wall panels and green facades, that enhance the thermal performance of buildings and align with sustainable building standards.

Moreover, advancements in building technology are influencing the US Exterior Wall Systems Market. The integration of smart technologies, such as building automation systems and intelligent facades, is becoming more prevalent. These technologies enhance the functionality of exterior wall systems by allowing for dynamic control of elements like shading, ventilation, and lighting. The market is responding to the demand for intelligent building solutions that optimize energy usage, improve occupant comfort, and contribute to overall building efficiency.

The push for resilient and durable building materials is another key trend in the US Exterior Wall Systems Market. With a focus on constructing structures that can withstand extreme weather conditions and environmental challenges, there is a growing demand for robust wall systems. High-performance materials, including fiber cement, metal panels, and composite materials, are gaining popularity for their durability, resistance to elements, and low maintenance requirements. This trend reflects the industry's commitment to building structures that stand the test of time and can adapt to changing climates.

Economic considerations are also influencing market trends in the exterior wall systems sector. The need for cost-effective building solutions has led to the popularity of prefabricated and modular wall systems. These systems offer efficiency in construction timelines, reduce labor costs, and provide consistent quality control. The market is witnessing an increased adoption of prefabricated exterior wall panels and modular construction methods, particularly in commercial and residential projects, as a means to streamline the building process and meet budget constraints.

In addition, architectural aesthetics are playing a significant role in shaping the exterior wall systems market. There is a growing emphasis on creating visually appealing facades and exterior designs that contribute to the overall aesthetics of a building. This trend has led to the development of diverse finishes, textures, and design options for exterior wall systems. Architects and designers are exploring innovative cladding materials and creative patterns to achieve unique and eye-catching exteriors, influencing the market towards a more design-centric approach.

The demand for green building certifications, such as LEED (Leadership in Energy and Environmental Design), is driving the adoption of environmentally friendly exterior wall systems in the US. Building owners and developers are increasingly seeking products that contribute to LEED credits and sustainable building practices. This trend is prompting manufacturers to offer eco-friendly wall systems that use recycled materials, have low embodied energy, and meet stringent environmental standards. The market's response to green building initiatives reflects a broader commitment to environmental responsibility and energy conservation.

E-commerce is impacting the distribution and procurement of exterior wall systems in the US. The convenience of online platforms for product discovery, comparison, and purchase has influenced the buying behavior of construction professionals and project managers. Manufacturers are adapting to this trend by enhancing their online presence, providing detailed product information, and offering digital tools that facilitate the selection and customization of exterior wall systems, contributing to the digitization of the construction industry.

Regulatory standards and building codes continue to shape the market trends in the US Exterior Wall Systems Market. Compliance with fire safety regulations, energy codes, and environmental standards is critical for product acceptance and adoption. Manufacturers are investing in research and development to ensure that their exterior wall systems meet or exceed the required regulatory specifications, providing assurances to architects, builders, and regulators about the safety and performance of their products.

Leave a Comment