Automotive Exterior Smart Lighting Market Summary

As per Market Research Future analysis, the Automotive Exterior Smart Lighting Market was estimated at 1.24 USD Billion in 2024. The Automotive Exterior Smart Lighting industry is projected to grow from 1.304 USD Billion in 2025 to 2.164 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.19% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Automotive Exterior Smart Lighting Market is poised for substantial growth driven by technological advancements and evolving consumer preferences.

- The market is witnessing a robust integration of advanced technologies, enhancing the functionality and appeal of automotive lighting systems.

- Energy efficiency remains a focal point, as manufacturers strive to develop sustainable lighting solutions that reduce overall vehicle energy consumption.

- Regulatory influences are shaping safety standards, compelling automakers to adopt innovative lighting solutions that enhance visibility and safety.

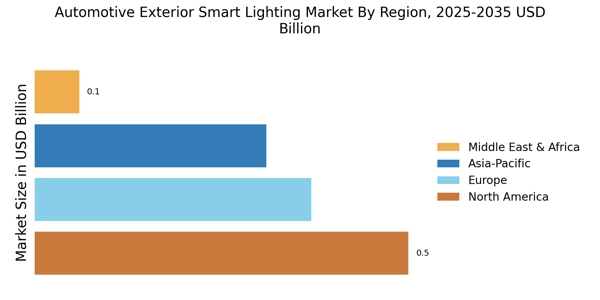

- Consumer demand for customization and advancements in autonomous vehicle technology are key drivers propelling growth, particularly in the North American and Asia-Pacific regions, with head lamps leading the market and brake/tail lights emerging rapidly in commercial vehicles.

Market Size & Forecast

| 2024 Market Size | 1.24 (USD Billion) |

| 2035 Market Size | 2.164 (USD Billion) |

| CAGR (2025 - 2035) | 5.19% |

Major Players

Valeo (FR), Hella (DE), Osram (DE), Magneti Marelli (IT), Koito Manufacturing (JP), Stanley Electric (JP), Aptiv (IE), LG Innotek (KR), Samsung Electronics (KR)