Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases in the US is a primary driver for the blood testing market. Conditions such as diabetes, cardiovascular diseases, and cancer necessitate regular monitoring and testing. According to the Centers for Disease Control and Prevention (CDC), approximately 6 in 10 adults in the US have a chronic disease, which underscores the demand for effective blood testing solutions. This trend is likely to propel the blood testing market as healthcare providers seek to implement routine testing protocols to manage these conditions effectively. Furthermore, the financial burden associated with chronic diseases, estimated at over $3.7 trillion annually, emphasizes the need for early detection and management, thereby driving growth in the blood testing market.

Increased Focus on Personalized Medicine

The shift towards personalized medicine is significantly influencing the blood testing market. As healthcare evolves, there is a growing emphasis on tailoring treatments based on individual patient profiles, which often requires comprehensive blood testing. This approach not only enhances treatment efficacy but also minimizes adverse effects. The market for personalized medicine is projected to reach $2.4 trillion by 2025, indicating a robust growth trajectory. Blood tests play a crucial role in this paradigm shift, providing essential data that informs treatment decisions. Consequently, the blood testing market is likely to expand as healthcare providers increasingly adopt personalized approaches to patient care.

Technological Innovations in Testing Methods

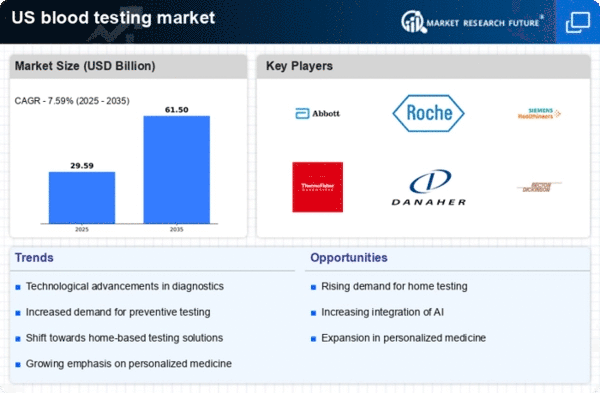

Technological advancements in blood testing methods are transforming the landscape of the blood testing market. Innovations such as point-of-care testing, liquid biopsy, and advanced diagnostic tools are enhancing the accuracy and speed of blood tests. For instance, the introduction of microfluidics technology has enabled rapid testing with minimal sample volumes, which is particularly beneficial in emergency settings. The blood testing market is expected to grow at a CAGR of 6.5% from 2025 to 2030, driven by these technological innovations. As healthcare providers seek to improve patient outcomes and streamline testing processes, the adoption of these advanced technologies is likely to accelerate.

Growing Demand for Home-Based Testing Solutions

The increasing demand for home-based testing solutions is reshaping the blood testing market. Patients are increasingly seeking convenience and autonomy in managing their health, leading to a rise in at-home blood testing kits. This trend is supported by advancements in technology that allow for accurate and reliable testing outside traditional laboratory settings. The home healthcare market is projected to reach $515 billion by 2027, indicating a substantial opportunity for blood testing solutions. As consumers prioritize ease of use and accessibility, the blood testing market is likely to experience significant growth in the development and distribution of home testing products.

Regulatory Support for Innovative Testing Solutions

Regulatory support for innovative testing solutions is a crucial driver for the blood testing market. The US Food and Drug Administration (FDA) has been actively streamlining the approval process for new diagnostic tests, which encourages innovation and expedites the availability of advanced blood testing solutions. This regulatory environment fosters competition and drives investment in research and development within the blood testing market. As a result, companies are more inclined to introduce novel testing methods that meet regulatory standards, thereby enhancing the overall market landscape. The positive regulatory climate is likely to stimulate growth and innovation in the blood testing market.